In 20-- the annual salaries paid each of the officers of Perez, Inc., follow. The officers are

Question:

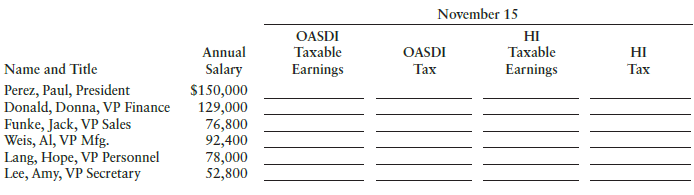

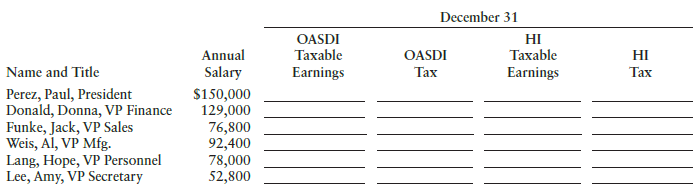

In 20-- the annual salaries paid each of the officers of Perez, Inc., follow. The officers are paid semimonthly on the 15th and the last day of the month. Compute the FICA taxes to be withheld from each officer’s pay on November 15 and December 31.

Transcribed Image Text:

November 15 HI Taxable Earnings OASDI Тахable Earnings Annual OASDI Тах HI Name and Title Perez, Paul, President Donald, Donna, VP Finance Funke, Jack, VP Sales Weis, Al, VP Mfg. Salary $150,000 Тах 76,800 92,400 78,000 52,800 Lang, Hope, VP Personnel Lee, Amy, VP Secretary December 31 OASDI Taxable Earnings HI Taxable Annual OASDI Tax HI Тах Name and Title Perez, Paul, President Donald, Donna, VP Finance Funke, Jack, VP Sales Weis, Al, VP Mfg. Lang, Hope, VP Personnel Lee, Amy, VP Secretary Salary Earnings $150,000 129,000 76,800 92,400 78,000 52,800

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 50% (8 reviews)

Name and Title Perez Paul President Donald Donna VP Finance Funke Jack VP Sales Weis Al ...View the full answer

Answered By

PALASH JHANWAR

I am a Chartered Accountant with AIR 45 in CA - IPCC. I am a Merit Holder ( B.Com ). The following is my educational details.

PLEASE ACCESS MY RESUME FROM THE FOLLOWING LINK: https://drive.google.com/file/d/1hYR1uch-ff6MRC_cDB07K6VqY9kQ3SFL/view?usp=sharing

3.80+

3+ Reviews

10+ Question Solved

Related Book For

Question Posted:

Students also viewed these Business questions

-

Amanda Autry and Carley Wilson are partners in A & W Gift Shop, which employs the individuals listed below. Paychecks are distributed every Friday to all employees. Based on the information given,...

-

At Gleeson Brewing Company, office workers are employed for a 40-hour workweek on either an annual or a monthly salary basis. Given on the form below are the current annual and monthly salary rates...

-

During 2018, Jake Gore worked for two different employers. Until May, he worked for Wonderman Construction Company in Kansas City, Kansas, and earned $21,500. The state unemployment rate for...

-

Yang Company purchased 2,000 widgets and has 400 widgets in its ending inventory at a cost of $90 each and a current replacement cost of $80 each. The net realizable value of each unit in the ending...

-

Let p, q be primitive statements for which the implication p q is false. Determine the truth values for each of the following. (a) p q (b) p q (c) q p (d) q p

-

For the quadratic equation ax 2 + bx + c = 0, if a, b, and c are integers, the sum of the roots is a rational number. Explain.

-

Account for and prepare financial statements of proprietary funds. AppendixLO1

-

1. What would be the reasons for and against Christina and David Sloan working for Tortilla King? 2. What advice would you offer Sloan?

-

Required: 1. Prepare the September 30 bank reconciliation for this company. CHAVEZ COMPANY Bank statement balance Add: Bank Reconciliation September 30 Book balance Add: 0 0 0 0 Deduct: Deduct:...

-

Consider a beam AB supported by an elastic rod BC at point B as shown in Figure 10.16. The beam is subjected to uniform load p(x). Use Young's modulus E for the entire structure and cross-sectional...

-

Eric Sherm began working as a part-time waiter on April 2, 2018, at Yardville Restaurant. The cash tips of $475 that he received during April were reported on Form 4070, which he submitted to his...

-

George Parker was paid a salary of $74,700 during 20-- by Umberger Company. In addition, during the year, Parker started his own business as a public accountant and reported a net business income of...

-

Let \(\mathbf{F}=\left\langle y^{2}, 2 z+x, 2 y^{2}ightangle\). Use Stokes' Theorem to find a plane with equation \(a x+b y+c z=0\) (where \(a, b, c\) are not all zero) such that \(\oint_{C}...

-

From your reading this unit on motivation and change from the TIP series, what is the connection and interplay between these concepts/statements below in your opinion in working with clients facing...

-

Please help with the following The partnership of Bauer, Ohtani, and Souza has elected to cease all operations and liquidate its business property. A balance sheet drawn up at this time shows the...

-

Pacifico Company, a U.S.-based importer of beer and wine, purchased 1,200 cases of Oktoberfest-style beer from a German supplier for 276,000 euros. Relevant U.S. dollar exchange rates for the euro...

-

Define meaning of partnership deed.

-

List down the information contains in the partnership deed.

-

For the following exercises, use like bases to solve the exponential equation. 4 3v2 = 4 v

-

Use the following data to answer the next two (2) questions: Product 1 Product 2 Product 3 Direct Material Cost $25,000 $30,000 $35,000 Direct Labor Cost $30,000 $40,000 $50,000 Direct Labor Hours...

-

Who is covered by the Walsh-Healey Public Contracts Act?

-

What are the major provisions of the Occupational Safety and Health Act (OSHA)?

-

Under the Family and Medical Leave Act, what is the maximum number of weeks of unpaid leave that a covered employer is required to offer an employee whose spouse is seriously ill?

-

1. Why might managers of small restaurants decide not to adopt the standard work hour approach to controlling labour cost? (minimum 150 words )

-

Which statement is true regarding the U.S. GAAP impairment test for limited life intangibles? A. U.S. GAAP impairment is likely to be greater than IFRS impairment. B. The impairment test for limited...

-

Which of the following is a limitation of both return on investment and residual income? A. Favors large units. B. There is disincentive for high return on investment units to invest. C. Can lead to...

Study smarter with the SolutionInn App