In 20-- the annual salaries paid each of the officers of Abrew, Inc., follow. The officers are

Question:

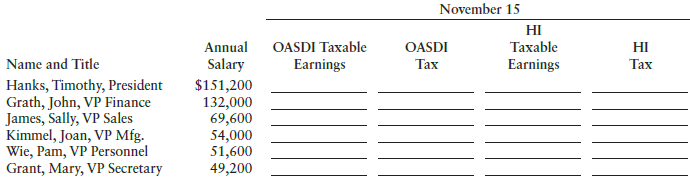

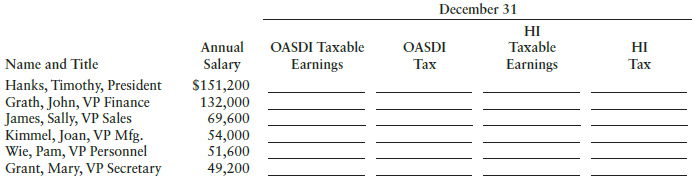

In 20-- the annual salaries paid each of the officers of Abrew, Inc., follow. The officers are paid semimonthly on the 15th and the last day of the month. Compute the FICA taxes to be withheld from each officer’s pay on (a) November 15 and (b) December 31.

a.

b.

Transcribed Image Text:

November 15 HI Тахable Earnings Annual OASDI Taxable Earnings OASDI Тах HI Name and Title Hanks, Timothy, President Grath, John, VP Finance Salary $151,200 132,000 Тах James, Sally, VP Sales Kimmel, Joan, VP Mfg. Wie, Pam, VP Personnel 54,000 51,600 Grant, Mary, VP Secretary 49,200 December 31 HI Taxable OASDI Taxable Earnings OASDI НI Annual Salary $151,200 Name and Title Hanks, Timothy, President Grath, John, VP Finance James, Sally, VP Sales Kimmel, Joan, VP Mfg. Wie, Pam, VP Personnel Grant, Mary, VP Secretary Tax Earnings Tax 69,600 54,000 49,200

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 72% (11 reviews)

a b Name and Title Hanks Timothy President Grath John VP Finance James Sally VP Sales Kim...View the full answer

Answered By

Deborah Joseph

My experience has a tutor has helped me with learning and relearning. You learn everyday actually and there are changes that are made to the curriculum every time so being a tutor has helped in keeping me updated about the present curriculum and all.

I have also been able to help over 100 students achieve better grades particularly in the categories of Math and Biology both in their internal examinations and external examinations.

5.00+

2+ Reviews

10+ Question Solved

Related Book For

Question Posted:

Students also viewed these Business questions

-

Ralph Henwood was paid a salary of $64,600 during 20-- by Odesto Company. In addition, during the year Henwood started his own business as a public accountant and reported a net business income of...

-

The taxable wages and withheld taxes for Stafford Company (EIN 00-0001462), semiweekly depositor, for the first quarter of 2018 follow. a. Complete Schedule B of Form 941 on page 3-51 for the first...

-

During 2018, Jordan Company was subject to the Alaska state unemployment tax of 4.2%. The companys taxable wages for FUTA were $86,700 and for SUTA, $171,000. Compute: a. SUTA tax that Jordan Company...

-

Modify BST to add a method size() that returns the number of key-value pairs in the symbol table. Use the approach of storing within each Node the number of nodes in the subtree rooted there.

-

Twelve patrons, six each with a $5 bill and the other six each with a $10 bill, are the first to arrive at a movie theater, where the price of admission is five dollars. In how many ways can these 12...

-

Perform the indicated operations for the resulting complex numbers if the given changes are made in the indicated examples of this section. In Example 3, change the sign of the imaginary part of the...

-

OS Environmental provides cost-effective solutions for managing regulatory requirements and environmental needs specific to the airline industry. Assume that on July 1 the company issues a one-year...

-

Following are the amounts of the assets and liabilities of Oriental Travel Agency at December 31, 2014, the end of the current year, and its revenue and expenses for the year. The retained earnings...

-

Martinez Company's relevant range of production is 7 , 5 0 0 units to 1 2 , 5 0 0 units. When it produces and sells 1 0 , 0 0 0 units, its average costs per unit are as follows: \ table [ [ , Average...

-

General Mills, Inc. is a global consumer foods company. The firm manufactures and sells a wide range of branded products and is a major supplier to the foodservice and baking industries. The...

-

Ernie Gilmore began working as a part-time waiter on June 1, 2018, at Sporthouse Restaurant. The cash tips of $390 that he received during June were reported on Form 4070, which he submitted to his...

-

The monthly and hourly wage schedule for the employees of Quirk, Inc., follows. No employees are due overtime pay. Compute the following for the last monthly pay of the year: a. The total wages of...

-

Alison accidentally omitted $40,000 of gross income from the restaurant she owned on her 2012 tax return. The return indicated gross income of $150,000 when it was filed on October 15, 2013. As of...

-

As a new principal, I assigned a teacher to a different grade for the coming year. I did not expect to cause the anxiety it did. The teacher first came to me in tears and begged for her assignment to...

-

Peruse the following websites to learn about the different ways of categorizing leadership. 1. https://www.businessnewsdaily.com/9789-leadership-types.html 2....

-

Making Consumer Choices The Espresso Machine (25 points) In real life, you must often make choices about whether to buy something pre-made or make it yourself. There are many things to consider:...

-

1) Read over the article/case and summarize what it is referring to in your own words. 2) What type of leadership traits can you describe in the case study? Use materials both from the handout and...

-

After reading or watching, https://smallbusiness.chron.com/internal-analysis-important-80513.html https://www.indeed.com/career-advice/career-development/internal-analysis...

-

For the following exercises, condense to a single logarithm if possible. log b (28) log b (7)

-

What are some of the possible sources of information about a company that could be used for determining the companys competitive stance?

-

The following time card shows the time worked one week by Hal Carsom. The employer disregards any time before 8:00 A.M. or between 12:00 and 1:00 P.M. and after 5:00 P.M. Employees do not begin work...

-

For the past several weeks, Adele Delgado, payroll manager for Petrillo Packing Company, has been studying the mounting costs of accrued vacations and sick leave. Most of her firm's employees are...

-

Huche Company allows its employees to carry over unused personal time off (PTO) days (vacation, sick days, etc.) from year to year. In addition, employees have the option to "cash out" their unused...

-

Lou Barlow, a divisional manager for Sage Company, has an opportunity to manufacture and sell one of two new products for a five - year period. His annual pay raises are determined by his division s...

-

Consider a 5 year debt with a 15% coupon rate paid semi-annually, redeemable at Php1,000 par. The bond is selling at 90%. The flotation cost is Php50 per bind. The firm's tax bracket is 30%.

-

A project will generate annual cash flows of $237,600 for each of the next three years, and a cash flow of $274,800 during the fourth year. The initial cost of the project is $749,600. What is the...

Study smarter with the SolutionInn App