The monthly and hourly wage schedule for the employees of Quirk, Inc., follows. No employees are due

Question:

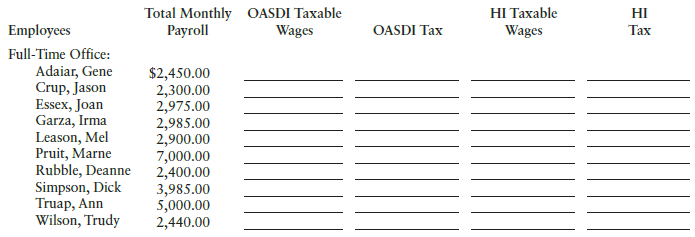

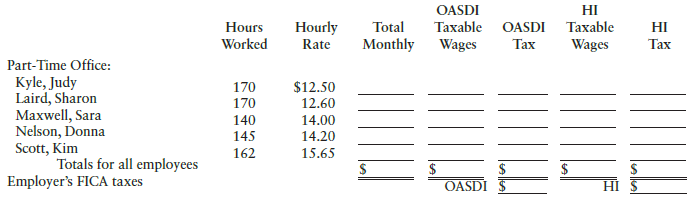

The monthly and hourly wage schedule for the employees of Quirk, Inc., follows. No employees are due overtime pay.

Compute the following for the last monthly pay of the year:

a. The total wages of each part-time employee for December 2018.

b. The OASDI and HI taxable wages for each employee.

c. The FICA taxes withheld from each employee’s wages for December.

d. Totals of columns.

e. The employer’s FICA taxes for the month.

Transcribed Image Text:

Total Monthly Payroll OASDI Taxable HI Taxable Wages HI Employees Full-Time Office: OASDI Tax Tax Wages Adaiar, Gene Crup, Jason Essex, Joan Garza, Irma Leason, Mel Pruit, Marne Rubble, Deanne Simpson, Dick Truap, Ann Wilson, Trudy $2,450.00 2,975.00 2,985.00 2,900.00 2,400.00 3,985.00 5,000.00 2,440.00 Total OASDI Taxable HI Taxable Hourly OASDI Тах HI Hours Worked Rate Monthly Wages Wages Тах Part-Time Office: Kyle, Judy Laird, Sharon Maxwell, Sara Nelson, Donna Scott, Kim Totals for all employees Employer's FICA taxes $12.50 170 170 140 145 162 12.60 14.00 14.20 15.65 OASDÍ

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 85% (7 reviews)

FullTime Office Adaiar Gene Crup Jason Essex Joan Garza Irma Leason Mel Pruit Marne Rubble Dean...View the full answer

Answered By

Amos Kiprotich

I am a wild researcher and I guarantee you a well written paper that is plagiarism free. I am a good time manager and hence you are assured that your paper will always be delivered a head of time. My services are cheap and the prices include a series of revisions, free referencing and formatting.

4.90+

15+ Reviews

21+ Question Solved

Related Book For

Question Posted:

Students also viewed these Business questions

-

The names of the employees of Hogan Thrift Shop are listed on the following payroll register. Employees are paid weekly. The marital status and the number of allowances claimed are shown on the...

-

The monthly and hourly wage schedule for the employees of Quincy, Inc., follows. No employees are due overtime pay. Compute the following for the last monthly pay of the year: a. The total wages of...

-

Due to its experience rating, Ianelli, Inc., is required to pay unemployment taxes on its payroll as follows: 1. Under SUTA for New Mexico on taxable payroll of $28,000, the contribution rate is...

-

Suppose that \(\mathrm{x}\) is a linked-list Node. What is the effect of the following code fragment? \(t\). next \(=x\). next; \(x \cdot\) next \(=t ;\)

-

Verify that for each integer n ¥ 1, 1 2n

-

Perform the indicated operations for the resulting complex numbers if the given changes are made in the indicated examples of this section. In Example 2, change the sign of the angle in the second...

-

A spreadsheet containing R&E Supplies' 2018 pro forma financial forecast, as shown in Table 3.5, is available for download from McGraw-Hill's Connect or your course instructor (see the Preface for...

-

While analyzing data, an investigator treats each score as if it were contributed by a different subject even though, in fact, scores were repeated measures. What effect, if any, would this mistake...

-

If Reach Incorporated concluded that an investment originally classified as a trading security would now more appropriately be classified as held-to-maturity, Reibach would

-

Listed below in random order are the items to be included in the balance sheet of Deep River Lodge at December 31, 2011: Instructions a. Prepare a balance sheet at December 31, 2011. Include a proper...

-

Ralph Henwood was paid a salary of $64,600 during 20-- by Odesto Company. In addition, during the year Henwood started his own business as a public accountant and reported a net business income of...

-

Cruz Company has gathered the information needed to complete its Form 941 for the quarter ended September 30, 2018. Using the information presented below, complete Part 1 of Form 941, reproduced on...

-

In a study of 420,095 cell phone users in Denmark, it was found that 135 developed cancer of the brain or nervous system. If we assume that the use of cell phones has no effect on developing such...

-

1. What are the threats being faced by Indian General Insurance Ltd. (IGIL)? 2. What are its traditional strengths? What 'business definitions' should it follow while capitalizing on its traditional...

-

You go to discuss the incident and the client's claims with your supervisor. As you retell the incident, it is clear that your supervisor is not comfortable. You ask your supervisor for advice on the...

-

Case Study Two: Rawlings Rawlings is an American sports equipment manufacturing company based in Town and Country, Missouri, and founded in 1887. Rawings specializes in baseball equipment and...

-

The discussion is for Administrating organizational change course. (we should write 300 words) Discussion question is: Refer to table 6.4 in your book. Think of a time when you were introduced to...

-

Content: Identify at least two resources for each of the four critical sections in the course project: Strategic Planning, Healthcare Reimbursement, Revenue Cycle Process, and Reimbursement...

-

For the following exercises, use logarithms to solve. 9 x10 = 1

-

Reduction in sales All of the above 29. Belt of an electric motor is broken, it needs a. Corrective maintenance b. Scheduled maintenance c. Preventive maintenance d. Timely maintenance. 30. The...

-

Ralph Henwood was paid a salary of $64,600 during 20-- by Odesto Company. In addition, during the year Henwood started his own business as a public accountant and reported a net business income of...

-

Empty Fields Company pays its salaried employees monthly on the last day of each month. The annual salary payroll for 20-- follows. Compute the following for the payroll of December 31: OASDI Taxable...

-

For social security purposes, what conditions must an individual meet to be classified as a "covered" employer?

-

. Emerson Cammack wishes to purchase an annuity contract that will pay him $7,000 a year for the rest of his life. The Philo Life Insurance Company figures that his life expectancy is 20 years, based...

-

Integrity Inc. can sell 20-year, $1,000 par value bonds paying semi-annual interests with a 10% coupon. The bonds can be sold for $1,050 each; flotation cost of $50 per bond will be incurred in this...

-

Duncan Inc. issued 500, $1,200, 8%, 25 year bonds on January 1, 2020, at 102. Interest is payable on January 1. Duncan uses straight-line amortization for bond discounts or premiums. INSTRUCTIONS:...

Study smarter with the SolutionInn App