Refer to Problem 3-11B. Complete Parts 2, 4, and 5 of Form 941 (on page 3-59) for

Question:

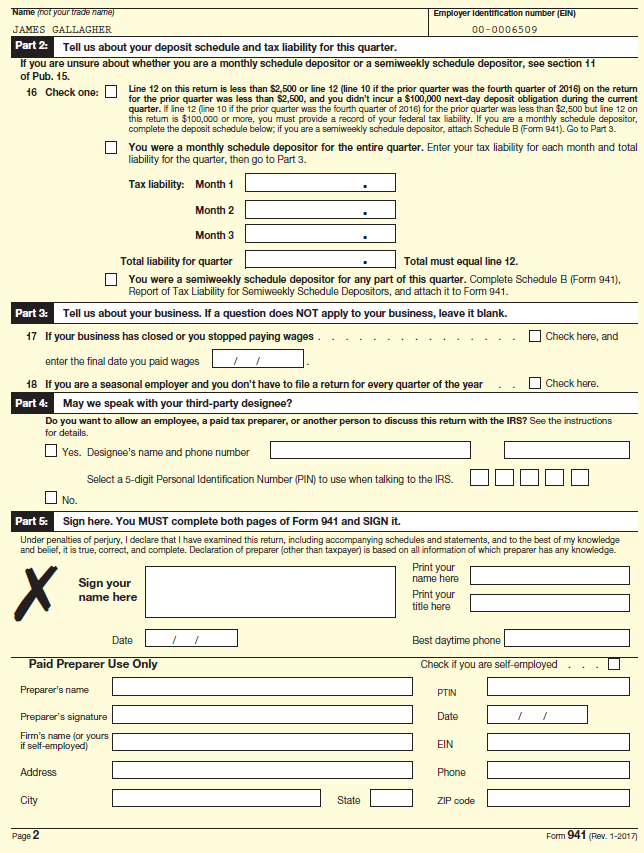

Refer to Problem 3-11B. Complete Parts 2, 4, and 5 of Form 941 (on page 3-59) for Gallagher Company for the third quarter of 2018. Gallagher Company is a monthly depositor with the following monthly tax liabilities for this quarter:

July ............................... $7,891.75

July ............................... $7,891.75

August ......................... 7,984.90

September .................. 7,989.27

State unemployment taxes are only paid to California. The company does not use a third-party designee, the tax returns are signed by the president, James Gallagher (Phone: 916-555-9739), and the date filed is October 31, 2018.

Transcribed Image Text:

Name (not your frade nne) Employer Identification number (EIN) JAMES GALLAGHER 00-0006509 Part 2 Tell us about your deposit schedule and tax liability for this quarter. If you are unsure about whether you are a monthly schedule depositor or a semiweekly schedule depositor, see section 11 of Pub. 15. Line 12 on this return is less than $2,500 or line 12 (line 10 if the prior quarter was the fourth quarter of 2016) on the return for the prior quarter was less than $2,500, and you didn't incur a $100,000 next-day deposit obligation during the current quarter. If ine 12 (line 10 if the prior quarter was the fourth quarter of 2016) for the prior quarter was less than $2500 but line 12 on this retum is $100,000 or more, you must provide a record of your federal tax liability. If you are a monthly schedule depositor, complete the deposit schedule below; if you are a semiweekly schedule depositor, attach Schedule B (Form 941). Go to Part 3. 16 Check one: You were a monthly schedule depositor for the entire quarter. Enter your tax liability for each month and total liability for the quarter, then go to Part 3. Month 1 Tax liability: Month 2 Month 3 Total liability for quarter Total must equal line 12. You were a semiweekly schedule depositor for any part of this quarter. Complete Schedule B (Form 941), Report of Tax Liability for Semiweekly Schedule Depositors, and attach it to Form 941. Part 3 Tell us about your business. If a question does NOT apply to your business, leave it blank. 17 If your business has closed or you stopped paying wages . Check here, and enter the final date you paid wages 18 If you are a seasonal employer and you don't have to file a return for every quarter of the year Part 4: May we speak with your third-party designee? Check here. Do you want to allow an employee, a paid tax preparer, or another person to discuss this retum with the IRS? See the instructions for details. O Yes. Designee's name and phone number Select a 5-digit Personal Identification Number (PIN) to use when talking to the IRS. O No. Part 5: Sign here. You MUST complete both pages of Form 941 and SIGN it. Under penalties of perjury, I declare that I have examined this return, including accompanying schedules and statements, and to the best of my knowledge and belief, it is true, correct, and complete. Declaration of preparer (other than taxpayer) is based on all information of which preparer has any knowledge. Print your name here х Sign your name here Print your title here Best daytime phone Date Paid Preparer Use Only Check if you are self-employed Preparer's name PTIN Date Preparer's signature Firm's name (or yours if self-employed) EIN Address Phone City State ZIP code Form 941 (Rev. 1-2017) Page 2

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 70% (10 reviews)

Name not your trade name JAMES GALLAGHER Part 2 Tell us about your deposit schedule and tax liability for this quarter If you are unsure about whether ...View the full answer

Answered By

Rayan Gilbert

I have been teaching since I started my graduation 3 years ago. As a student, working as Teacher/PA has been tough but made me learn the needs for student and how to help them resolve their problems efficiently. I feel good to be able to help out students because I'm passionate about teaching. My motto for teaching is to convey the knowledge I have to students in a way that makes them understand it without breaking a sweat.

5.00+

1+ Reviews

10+ Question Solved

Related Book For

Question Posted:

Students also viewed these Business questions

-

Garden Landscapers is a monthly depositor whose 4th quarter FUTA taxes and 4th quarter voluntary deductions are displayed below. Record one journal entry to account for the payment of federal...

-

James Company began the month of October with inventory of $15,000. The following inventory transactions occurred during the month: a. The company purchased merchandise on account for $22,000 on...

-

A business tax form is either filed on time or late, is either from a small or a large business, and is either accurate or inaccurate. There is an 1195 probability that a form is from a small...

-

The registrar at a prominent northeastern university recently scheduled an instructor to teach two different classes at the same exact time. Help the registrar prevent future mistakes by describing a...

-

Verify that [p (q r)] [(p q) (p r)] is a tautology.

-

Graph the given functions. f(x) = 2x 2/3

-

Explain the necessity to introduce a deferred revenues account in the levy of capital special assessments. AppendixLO1

-

Boarders sells a snowboard, Xpert, that is popular with snowboard enthusiasts. Below is information relating to Boarderss purchases of Xpert snowboards during September. During the same month, 121...

-

Silven Industries, which manufactures and sells a highly successful line of summer lotions and insect repellents, has decided to diversify in order to stabilize sales throughout the year. A natural...

-

From the tenth floor of her office building, Katherine Rally watches the swarms of New Yorkers fight their way through the streets infested with yellow cabs and the sidewalks littered with hot dog...

-

Gallagher Company has gathered the information needed to complete its Form 941 for the quarter ended September 30, 2018. Using the information presented below, complete Part 1 of Form 941, reproduced...

-

Stan Barker opened Quik-Stop Market on January 2, 2018. The business is subject to FICA taxes. At the end of the first quarter of 2018, Barker, as president of the company, must file Form 941,...

-

Brann, located in San Antonio, Texas, produces two lines of electric toothbrushes: deluxe and standard. Because Brann can sell all the toothbrushes it can produce, the owners are expanding the plant....

-

Determine dy/dr when 3x+4y = 3.

-

Problem 3. Doping a Semiconductor The following chemical scheme is used to introduce P-atoms as a dopant into a semiconductor - a silicon chip. POCI3 Cl POCI 3 vapor P P SiO2 + P(s) CVD coating Si...

-

The system shown in the following figure is in static equilibrium and the angle is equal to 34 degrees. Given that the mass1 is 8 kg and the coefficient of static friction between mass1 and the...

-

Pre-Writing step for a report for your boss on Richard Hackman's statement that using a team to complete a complex project may not be the best approach. Review your classmates' contributions to the...

-

For the graph of the equation x = y - 9, answer the following questions: the x- intercepts are x = Note: If there is more than one answer enter them separated by commas. the y-intercepts are y= Note:...

-

The graph of f(x) = 10 x is reflected about the x-axis and shifted upward 7 units. What is the equation of the new function, g(x)? State its y-intercept, domain, and range.

-

Why do markets typically lead to an efficient outcome for buyers and sellers?

-

In staffing their offices, some firms encourage in-house referrals (recommendations of their present employees). What are some possible objections to this practice as a means of obtaining job...

-

The main office of a large bank has an annual turnover of 500 office workers. As an employment officer of this bank, discuss the sources you would use in obtaining replacement employees.

-

Among the questions asked on the application for employment form of Horner Company are the following: a. What is the name of your church and what religious holidays do you observe? b. What is the...

-

ABC Company engaged in the following transaction in October 2 0 1 7 Oct 7 Sold Merchandise on credit to L Barrett $ 6 0 0 0 8 Purchased merchandise on credit from Bennett Company $ 1 2 , 0 0 0 . 9...

-

Lime Corporation, with E & P of $500,000, distributes land (worth $300,000, adjusted basis of $350,000) to Harry, its sole shareholder. The land is subject to a liability of $120,000, which Harry...

-

A comic store began operations in 2018 and, although it is incorporated as a limited liability company, it decided to be taxed as a corporation. In its first year, the comic store broke even. In...

Study smarter with the SolutionInn App