Country Pet Industries has employees with pay schedules that vary based on job classification. Compute each employees

Question:

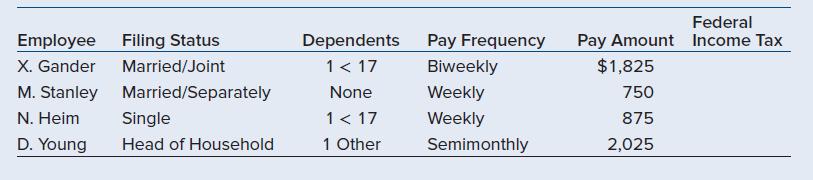

Country Pet Industries has employees with pay schedules that vary based on job classification. Compute each employee’s federal income tax liability using the percentage method for manual payroll systems in Appendix C. All Form W-4s were received in 2022. No one checked the box in Step 2 and there was no additional information in Step 4.

Transcribed Image Text:

Employee X. Gander M. Stanley N. Heim D. Young Filing Status Married/Joint Married/Separately Single Head of Household Dependents 1 < 17 None 1 < 17 1 Other Pay Frequency Biweekly Weekly Weekly Semimonthly Federal Pay Amount Income Tax $1,825 750 875 2,025

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 50% (6 reviews)

To compute each employees federal income tax liability using the percentage method we will use the I...View the full answer

Answered By

Dulal Roy

As a tutor, I have gained extensive hands-on experience working with students one-on-one and in small group settings. I have developed the ability to effectively assess my students' strengths and weaknesses, and to customize my teaching approach to meet their individual needs.

I am proficient at breaking down complex concepts into simpler, more digestible pieces, and at using a variety of teaching methods (such as visual aids, examples, and interactive exercises) to engage my students and help them understand and retain the material.

I have also gained a lot of experience in providing feedback and guidance to my students, helping them to develop their problem-solving skills and to become more independent learners. Overall, my hands-on experience as a tutor has given me a deep understanding of how to effectively support and encourage students in their learning journey.

0.00

0 Reviews

10+ Question Solved

Related Book For

Payroll Accounting 2023

ISBN: 9781264415618

9th Edition

Authors: Jeanette M. Landin, Paulette Schirmer

Question Posted:

Students also viewed these Business questions

-

GL Kennels has employees with pay schedules that vary based by job classification. Compute the federal tax liability for each employee using the percentage method.

-

Wynne and Associates has employees with pay schedules that vary based by job classification. Compute the federal tax liability for each employee using the percentage method.

-

Compute the Federal income tax liability for the Valerio Trust. The entity reports the following transactions for the 2015 tax year. The trustee accumulates all accounting income for the year....

-

Quick Fix-it Corporation was organized in January 2011 to operate several car repair businesses in a large metropolitan area. The charter issued by the state authorized the following capital stock:...

-

Explain how allocation of support service costs is useful for planning and control and in making pricing decisions.

-

Differentiate between a meeting and an event. LO.1

-

Improving SAT scores. Refer to the Chance (Winter 2001) study of students who paid a private tutor (or coach) to help them improve their SAT scores, presented in Exercise 2.197 (p. 136). Multiple...

-

Consider a two-stage rocket made up of two engine stages, each of inertia m when empty, and a payload of inertia m . Stages 1 and 2 each contain fuel of inertia m , so that the rocket's inertia...

-

Required information Use the following information for the Problems below. (Algo) [The following information applies to the questions displayed below.] Hillside issues $3,000,000 of 6%,15-year bonds...

-

Shem soft Software Technicians recently accepted a contract to develop an inventory management system for Chez and Company. Shem soft is required to complete the installation of the new inventory...

-

Which of the following are steps in computing federal income tax withholding using the percentage method? a. Compute and record dependents. b. Apply the tax rate to the taxable portion of the...

-

Wolfe Industries pays its employees on a semimonthly basis. Using the wagebracket tables in Appendix C, compute the federal income tax deductions for the following employees of Wolfe Industries. No...

-

Why do traditional cost accounting systems tend to analyze manufacturing costs in greater detail than they do other functional categories of costs?

-

Ja-San Company was started on January 1,2007, when the owners invested \($160,000\) cash in the business. During 2007, the company earned cash revenues of \($90,000\) and incurred cash expenses of...

-

Write a program using the programming language of your choice to implement the representation you designed for Review Question 3.3. Have your program solve the problem, and have it show on the screen...

-

All the lenses in Figure P33.98 are surrounded by air. Which of the lenses are converging, and which are diverging? Data from Figure P33.98 A B C D E F )(II)

-

Change the Growth and GrowthDriver classes described in the Improved Accuracy and Efficiency. Using a Step-with-Midpoint Algorithm subsection. Run your modified program with these inputs: For your...

-

For the three-element series circuit in Fig. 9-39, (a) Find the current I; (b) Find the voltage across each impedance and construct the voltage phasor diagram which shows that V 1 + V 2 + V 3 = 100 0...

-

Two balls are thrown from a tall bridge. One is thrown upward with an initial velocity +v 0 , while the other is thrown downward with an initial velocity -v 0 . Which one has the greater speed just...

-

Uniform electric field in Figure a uniform electric field is directed out of the page within a circular region of radius R = 3.00 cm. The magnitude of the electric field is given by E = (4.50 x 10-3...

-

How did LGs new logistics and transportation management system improve management decision making? Describe two decisions that the new system solution improved.

-

What was the problem at Celcom described in this case? What management, organization, and technology factors contributed to this problem?

-

What was Celcoms business strategy, and what was the role of customer relationship management in that strategy?

-

Minden Company introduced a new product last year for which it is trying to find an optimal selling price. Marketing studies suggest that the company can increase sales by 5,000 units for each $2...

-

Prepare the adjusting journal entries and Post the adjusting journal entries to the T-accounts and adjust the trial balance. Dresser paid the interest due on the Bonds Payable on January 1. Dresser...

-

Venneman Company produces a product that requires 7 standard pounds per unit. The standard price is $11.50 per pound. If 3,900 units required 28,400 pounds, which were purchased at $10.92 per pound,...

Study smarter with the SolutionInn App