Dallas is the payroll accountant at White Box Builders and is preparing an information package about voluntary

Question:

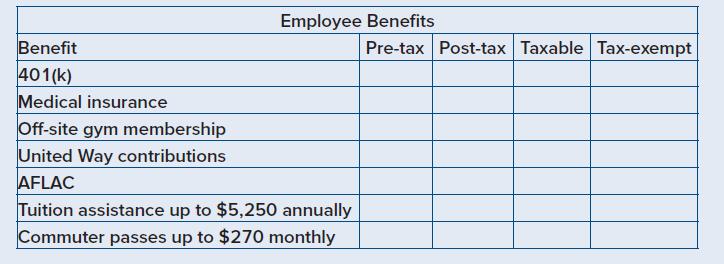

Dallas is the payroll accountant at White Box Builders and is preparing an information package about voluntary and fringe benefits. Using the following list of fringe benefits, classify each benefit as pre-tax or post-tax and as taxable or tax-exempt for federal income taxes.

Transcribed Image Text:

Employee Benefits Benefit 401(k) Medical insurance Off-site gym membership United Way contributions AFLAC Tuition assistance up to $5,250 annually Commuter passes up to $270 monthly Pre-tax Post-tax Taxable Tax-exempt

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 66% (9 reviews)

BeneFIT Pretax Posttax Taxable Taxexempt 401K Yes No Taxable Taxexemp...View the full answer

Answered By

Teresa ochieng

I have had several years of experience working as a tutor, both in person and online. I have worked with students of all ages and abilities, and have consistently received positive feedback from students and their parents.

As a tutor, I have honed my skills in breaking down complex concepts and explaining them in a way that is easily understood by my students. I am patient and understanding, and I am always willing to go the extra mile to help my students succeed.

I have a strong track record of helping my students improve their grades and test scores, and I have a passion for helping students reach their full potential. I have experience tutoring a wide range of subjects, including math, science, English, and history, and I am comfortable working with students at all levels.

Overall, I believe that my hands-on experience and proficiency as a tutor make me an excellent candidate for the SolutionInn Online Tutoring Platform. I am confident that I can provide valuable support and guidance to students who are looking to improve their academic performance.

0.00

0 Reviews

10+ Question Solved

Related Book For

Payroll Accounting 2023

ISBN: 9781264415618

9th Edition

Authors: Jeanette M. Landin, Paulette Schirmer

Question Posted:

Students also viewed these Business questions

-

Elijah Hamilton is the payroll accountant at White Box Builders. He is preparing an information package about voluntary and fringe benefits. Using the following list of fringe benefits, classify each...

-

Gavin Range is the payroll accountant for Comptech Industries. His employer decided to use the special accounting rule for 2018. Which months may be included in the special accounting rule?

-

Gavin Range is the payroll accountant for Comptech Industries. His employer decided to use the special accounting rule for 2017. Which months may be included in the special accounting rule?

-

Pricing in imperfect markets (continuation of 22-28). Refer to Problem 22-28. 1.Suppose the manager of Division A has the option of (a) cutting the external price to $195, with the certainty that...

-

Forchen, Inc., provided the following information for two of its divisions for last year: Required: 1. For the Small Appliances Division, calculate: a. Average operating assets b. Margin c. Turnover...

-

What are the common menu choices of fast-food restaurants? LO.1

-

In many project-oriented organizations, even routine processes are treated as projects. Why do you think this happened? How is it accomplished? LO6

-

The income statements of Evans Company and Falcon Company for the current year are shown below: The following amounts were taken from the statement of changes in equity for the two companies: Evans...

-

Denormalization never results in second normal-form tables. True False

-

The March 31, 2011, edition of the Wall Street Journal includes an article by Russell Gold entitled Solar Gains TractionThanks to Subsidies. Instructions Read the article and answer the following...

-

The payroll accountant has received a court order for garnishment for an employees student loan payments. What must be considered in computing the garnishment? a. Year-to-date pay b. Hourly wage c....

-

The owner of Padua Products wants to reward the employees for their work during the year and asked you to gross-up their bonuses so that they receive the full amount as net pay. What amount(s) should...

-

Suppose the Stiles Trading Company has an empty warehouse in Philadelphia that can be used to store a new line of electronic pinball machines. The company hopes to sell these machines to affluent...

-

Saskatchewan Soy Products (SSP) buys soy beans and processes them into other soy products. Each tonne of soy beans that SSP purchases for $300 can be converted for an additional $200 into 500 lbs of...

-

Pharoah Acres sponsors a defined-benefit pension plan. The corporation's actuary provides the following information about the plan: January 1, 2025 December 31, 2025 Vested benefit obligation $510...

-

Company panther is compelled to pick between two machines An and B. The two machines are planned in an unexpected way, yet have indistinguishable limit and do the very same work. Machine A costs...

-

On April 30, 2023, a company issued $600,000 worth of 5% bonds at par. The term of the bonds is 9 years, with interest payable semi- annually on October 31 and April 30. The year-end of the company...

-

Identify the following; MethodBodyReturn statementReturn typeParameter Look at this example we saw in our Methods lesson: public double findTheArea (double length, double w idth) { double area =...

-

Two crates are connected by a mass less rope that passes over a pulley as shown in Figure 4.26. If the crates have mass 35 kg and 85 kg, what is their acceleration? If the system begins at rest, with...

-

Fill in each blank so that the resulting statement is true. 83 + 103 = ______ .

-

Discuss the role of the manufacturers agent in a marketing managers promotion plans. What kind of salesperson is a manufacturers agent? What type of compensation plan is used for a manufacturers...

-

Discuss the future of the specialty shop if producers place greater emphasis on mass selling because of the inadequacy of retail order-taking.

-

Think about a situation when you or a friend or family member encountered a problem with a purchase and tried to get help from a firms customer service representative. Briefly describe the problem,...

-

Jenny wanted to donate to her alma mater to set up a fund for student scholarships. If she would like to fund an annual scholarship in the amount of $6,000 and her donation can earn 5% interest per...

-

You would like to have a balance of $600,000 at the end of 15 years from monthly savings of $900. If your returns are compounded monthly, what is the APR you need to meet your goal?

-

Explain the importance of covariance and correlation between assets and understanding the expected value, variance, and standard deviation of a random variable and of returns on a portfolio.

Study smarter with the SolutionInn App