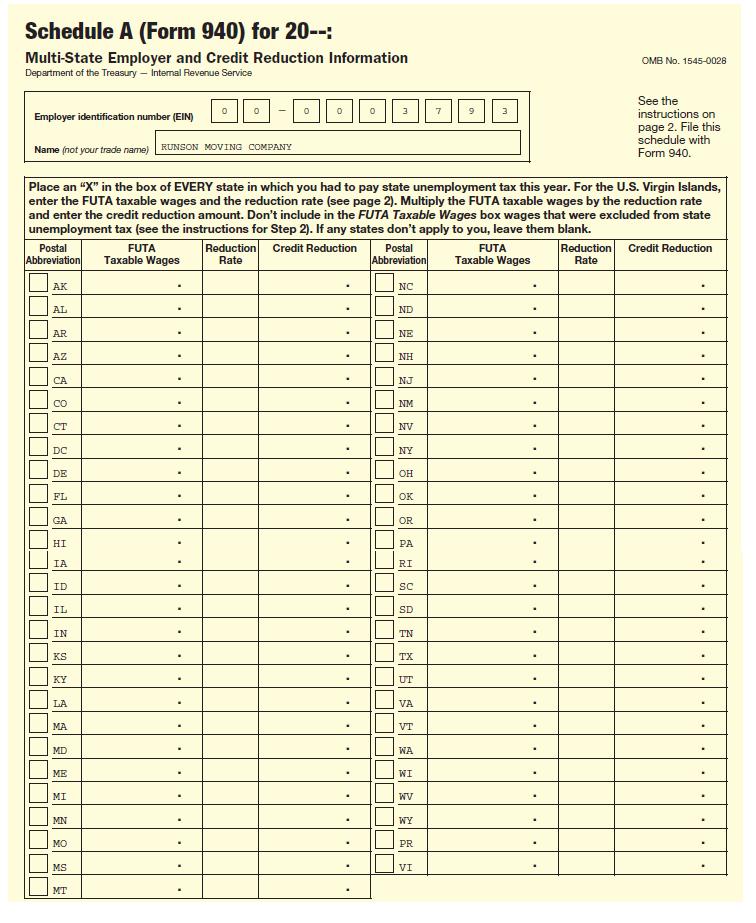

Form 940 A. Extra state unemployment contributions made by the employers B. Favorable employment records result in

Question:

Form 940

A. Extra state unemployment contributions made by the employers

B. Favorable employment records result in a lower SUTA tax

C. Annual Federal Unemployment Tax Return

D. Poor experience-rated companies form new companies with lower unemployment tax rates

E. Pay FUTA tax with Schedule H of Form 1040

F. Provide unemployment insurance coverage and payment of benefits to interstate workers

G. Borrowings from federal government to pay unemployment compensation benefits

H. Employers whose reserve account has been charged with more benefits paid out than contributions made

I. Quarterly threshold for mandatory depositing of FUTA taxes

J. Quarterly reports submitted to the state listing employees, SSNs, and taxable wages

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: