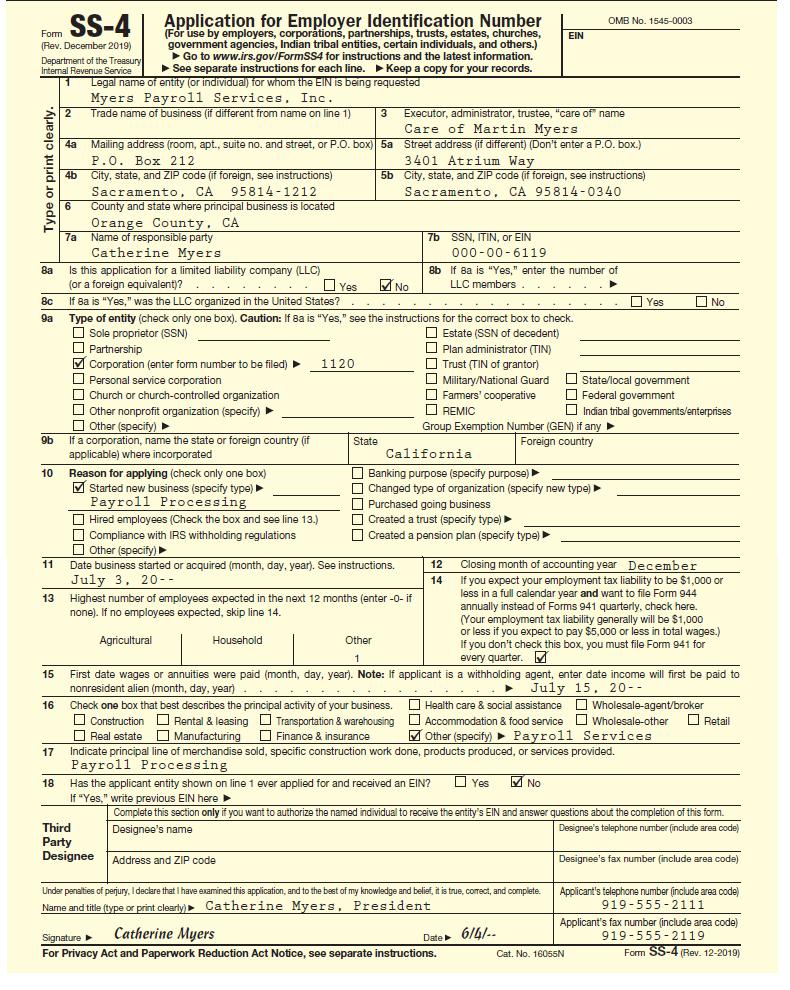

Form SS-4 A. Severance pay B. By the 15th day of the following month C. Employers QUARTERLY

Question:

Form SS-4

A. Severance pay

B. By the 15th day of the following month

C. Employer’s QUARTERLY Federal Tax Return

D. Application for Employer Identification Number

E. 6.2 percent and 1.45 percent

F. Employee’s application for social security card

G. Cumulative wages of $147,000

H. More than $50,000 in employment taxes in thelookback period

I. 12.4 percent and 2.9 percent

J. Employer’s matching contributions into employees’ deferred compensation arrangements

Transcribed Image Text:

Form SS-4 (Rev. December 2019) Department of the Treasury Internal Revenue Service Type or print clearly. 8c 9a 9b 8a Is this application for a limited liability company (LLC) (or a foreign equivalent)? . 10 11 13 15 16 17 Application for Employer Identification Number (For use by employers, corporations, partnerships, trusts, estates, churches, government agencies, Indian tribal entities, certain individuals, and others.) ►Go to www.irs.gov/FormSS4 for instructions and the latest information. ► See separate instructions for each line. Keep a copy for your records. Legal name of entity (or individual) for whom the EIN is being requested Myers Payroll Services, Inc. 2 Trade name of business (if different from name on line 1) 18 4a Mailing address (room, apt., suite no. and street, or P.O. box) 5a P.O. Box 212 4b City, state, and ZIP code (if foreign, see instructions) Sacramento, CA 95814-1212 6 County and state where principal business is located Orange County, CA 7a Name of responsible party Catherine Myers Partnership Corporation (enter form number to be filed) ► Personal service corporation Church or church-controlled organization Other nonprofit organization (specify) ► Other (specify) ► If a corporation, name the state or foreign country (if applicable) where incorporated Reason for applying (check only one box) Started new business (specify type) ► Payroll Processing Hired employees (Check the box and see line 13.) Compliance with IRS withholding regulations Other (specify) ► ...... If 8a is "Yes," was the LLC organized in the United States? o ne Type of entity (check only one box). Caution: If 8a is "Yes," see the instructions for the correct box to check. Sole proprietor (SSN) Estate (SSN of decedent) Plan administrator (TIN) Trust (TIN of grantor) Military/National Guard Farmers' cooperative REMIC Yes Household Third Party Designee 1120 State . Date business started or acquired (month, day, year). See instructions. July 3, 20-- 3 Executor, administrator, trustee, "care of" name Care of Martin Myers. Street address (if different) (Don't enter a P.O. box.) 3401 Atrium Way 5b City, state, and ZIP code (if foreign, see instructions) Sacramento, CA 95814-0340 No Highest number of employees expected in the next 12 months (enter -0- if none). If no employees expected, skip line 14. Agricultural Other 1 7b SSN, ITIN, or EIN 000-00-6119 8b If 8a is "Yes," enter the number of LLC members. California Banking purpose (specify purpose) ► Changed type of organization (specify new type) ► Purchased going business Created a trust (specify type) ► Created a pension plan (specify type) ► 12 14 EIN Group Exemption Number (GEN) if any ► Foreign country Signature Catherine Myers For Privacy Act and Paperwork Reduction Act Notice, see separate instructions. OMB No. 1545-0003 First date wages or annuities were paid (month, day, year). Note: If applicant is a withholding agent, enter date income will first be paid to nonresident alien (month, day, year) a war Check one box that best describes the principal activity of your business. Transportation & warehousing Finance & insurance ► July 15, 20-- Health care & social assistance Accommodation & food service Other (specify) ▸ Payroll Construction Real estate Rental & leasing Manufacturing Indicate principal line of merchandise sold, specific construction work done, products produced, or services provided. Payroll Processing Yes Date 6/4/.. Closing month of accounting year December If you expect your employment tax liability to be $1,000 or less in a full calendar year and want to file Form 944 annually instead of Forms 941 quarterly, check here. (Your employment tax liability generally will be $1,000 or less if you expect to pay $5,000 or less in total wages.) If you don't check this box, you must file Form 941 for every quarter. 7 Has the applicant entity shown on line 1 ever applied for and received an EIN? If "Yes," write previous EIN here ► Complete this section only if you want to authorize the named individual to receive the entity's EIN and answer questions about the completion of this form. Designee's name Designee's telephone number (include area code) Address and ZIP code Designee's fax number (include area code) Under penalties of perjury, I declare that I have examined this application, and to the best of my knowledge and belief, it is true, correct, and complete. Name and title (type or print clearly) Catherine Myers, President No Yes State/local government Federal goverment Indian tribal governments/enterprises No Cat. No. 16055N Wholesale-agent/broker Wholesale-other ☐Retail Services Applicant's telephone number (include area code) 919-555-2111 Applicant's fax number (include area code) 919-555-2119 Form SS-4 (Rev. 12-2019)

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 40% (5 reviews)

D Applicat...View the full answer

Answered By

Salmon ouma

I am a graduate of Maseno University, I graduated with a second class honors upper division in Business administration. I have assisted many students with their academic work during my years of tutoring. That has helped me build my experience as an academic writer. I am happy to tell you that many students have benefited from my work as a writer since my work is perfect, precise, and always submitted in due time. I am able to work under very minimal or no supervision at all and be able to beat deadlines.

I have high knowledge of essay writing skills. I am also well conversant with formatting styles such as Harvard, APA, MLA, and Chicago. All that combined with my knowledge in methods of data analysis such as regression analysis, hypothesis analysis, inductive approach, and deductive approach have enabled me to assist several college and university students across the world with their academic work such as essays, thesis writing, term paper, research project, and dissertation. I have managed to help students get their work done in good time due to my dedication to writing.

5.00+

4+ Reviews

16+ Question Solved

Related Book For

Question Posted:

Students also viewed these Business questions

-

Employees FICA tax rates A. Severance pay B. By the 15th day of the following month C. Employers QUARTERLY Federal Tax Return D. Application for Employer Identification Number E. 6.2 percent and 1.45...

-

Semiweekly depositor A. Severance pay B. By the 15th day of the following month C. Employers QUARTERLY Federal Tax Return D. Application for Employer Identification Number E. 6.2 percent and 1.45...

-

Taxable for FICA A. Severance pay B. By the 15th day of the following month C. Employers QUARTERLY Federal Tax Return D. Application for Employer Identification Number E. 6.2 percent and 1.45 percent...

-

Roasters Limited is a coffee-blending firm. It produces a special blend of coffee known as "Utopia Blend" by mixing two grades of coffee "AB" and "QP" as follows: Material AB QP Standard mix ratio AB...

-

Telephone and electrical lines are allowed to sag between poles so that the tension will not be too great when something hits or sits on the line. (a) Is it possible to have the lines perfectly...

-

What benefits are there to management from using a combined cost of production report instead of a separate statement for each department? LO.1

-

1. Why should you estimate the value of a bank by employing the equity cash flow method, rather than the enterprise DCF models stressed throughout the text?

-

Petroleum Research, Inc. (A), and Extraction International, Inc. (B), have each developed a new extraction procedure that will remove metal and other contaminants from used automotive engine oil. The...

-

Problem 4 A - 4 ( Algo ) Super - Variable Costing and Variable Costing Unit Product Costs and Income Statements [ LO 4 - 2 , LO 4 - 6 ] Ogilvy Company manufactures and sells one product. The...

-

ATV Co. began operations on March 1 and uses a perpetual inventory system. It entered into purchases and sales for March as shown in the Tableau Dashboard. Legend No Purchases or Sales Purchases...

-

Affordable Care Act A. Also known as the Federal Wage and Hour Law. B. Record used in preparing employees W-2. C. Protection against losses due to work-related injuries. D. Multicolumn form used to...

-

What are an employers responsibilities for FICA taxes on: a. Tips reported by employees? b. Wages paid tipped employees?

-

Fill in each blank so that the resulting statement is true. A solution to a system of linear equations in two variables is an ordered pair that__________ .

-

What volumetric airflow rate (Qa) is required to maintain a G value of 500s-1 in a basin that is 2.75 m deep and provides a liquid detention time of 5 min? Perform the exercise for water temperatures...

-

Read this article, then answer the following questions: 1- Description of Instrument: a. Title of instrument, author(s), publication date 2/18/24, 5:43 PM Abuse Risk Inventory for Women: EBSCOhost...

-

Suppose that there is a magnetic field B(x, y, z) = x2 filling a 3D space. The coordinates are set up as a Cartesian coordinate system with = 2. For all the discussions below, ignore the units. a)...

-

A vertical solid cylinder of uniform cross-sectional area A floats in water. The cylinder is partially submerged. When the cylinder floats at rest, a mark is aligned with the water surface. The...

-

Non-manufacturing fixed cost for year 2011 equal to:$60,780 out of which half are Administrative expenses.Administrative expenses are expected to increase by: 10%The total Variable nonmanufacturing...

-

The vertical line passing through the vertex of a parabola is called the _________.

-

What is a lobbyist in US? How did this term emerge?

-

Eaton Enterprises uses the wage-bracket method to determine federal income tax withholding on its employees. Find the amount to withhold from the wages paid each employee. Payroll Period W-Weekly No....

-

The names of the employees of Hogan Thrift Shop are listed on the following payroll register. Employees are paid weekly. The marital status and the number of allowances claimed are shown on the...

-

Damerly Company (a California employer) wants to give a holiday bonus check of $250 to each employee. Since it wants the check amount to be $250, it will need to gross-up the amount of the bonus....

-

Discuss American History

-

Your firm has developed a new lithium ion battery polymer that could enhance the performance of lithion ion batteries. These batteries have applications in many markets including cellphones, laptops,...

-

Need help analyzing statistical data 1. ANOVA) True or false: If we assume a 95% confidence level, there is a significant difference in performance generally across all groups. 2. (t-test) True or...

Study smarter with the SolutionInn App