How should employees complete their Form W-4 if they have multiple jobs or have a spouse who

Question:

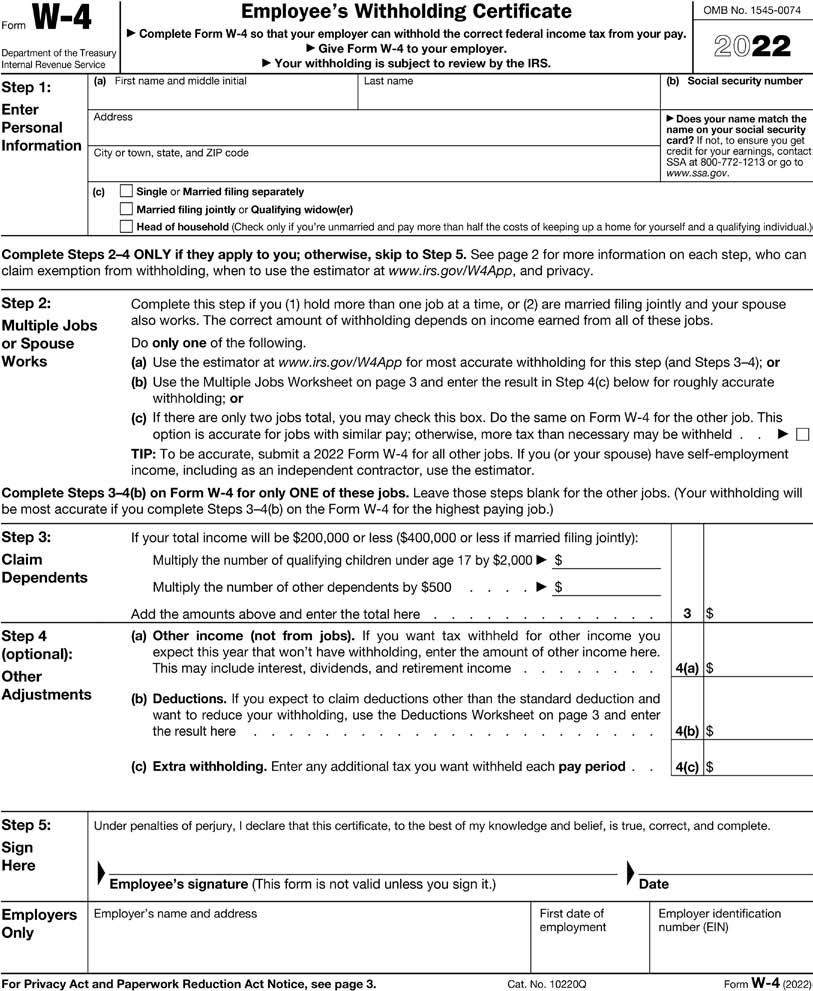

How should employees complete their Form W-4 if they have multiple jobs or have a spouse who works?

Transcribed Image Text:

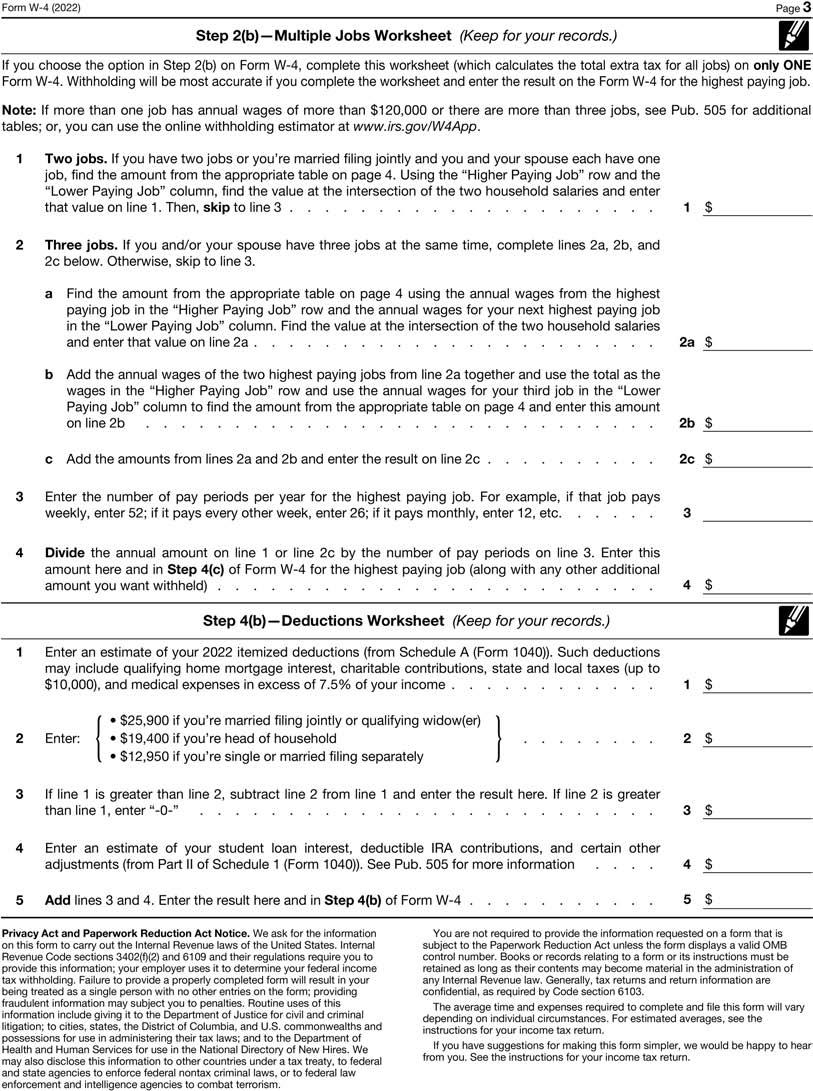

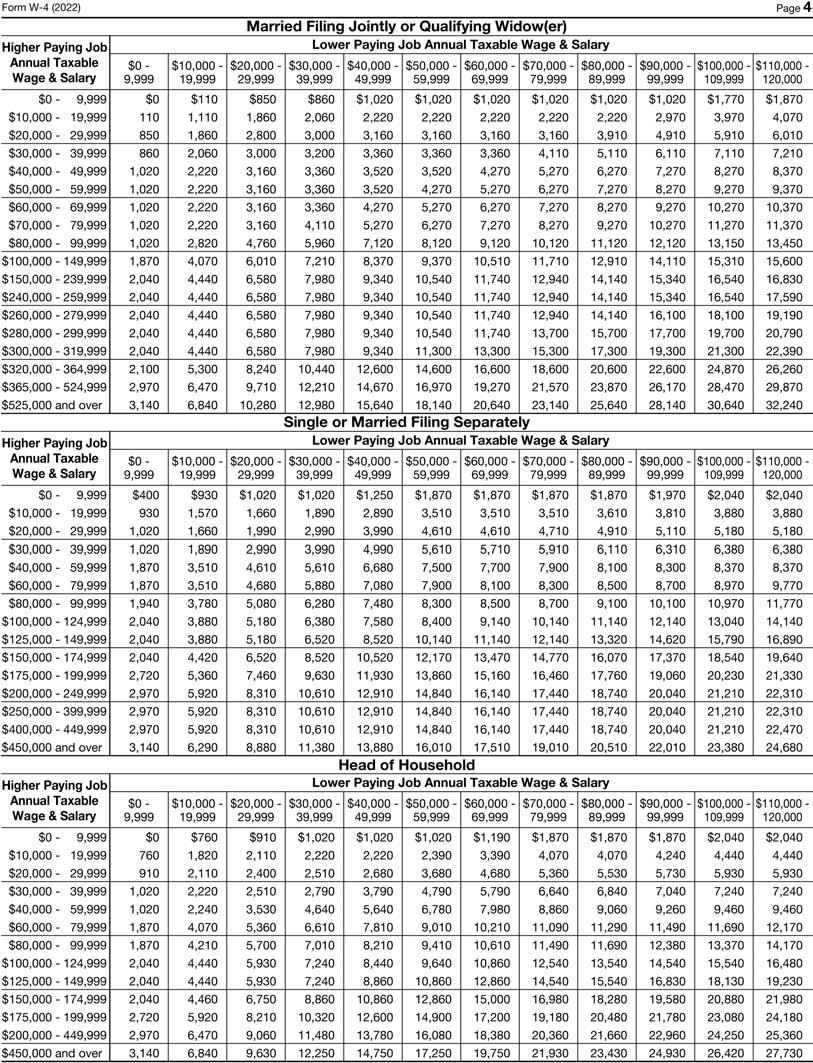

W-4 Department of the Treasury Internal Revenue Service Form Step 1: Enter Personal Information Step 3: Claim Dependents (a) First name and middle initial Step 4 (optional): Other Adjustments Employee's Withholding Certificate ► Complete Form W-4 so that your employer can withhold the correct federal income tax from your pay. ► Give Form W-4 to your employer. ►Your withholding is subject to review by the IRS. Last name Address Step 2: Multiple Jobs or Spouse Works Step 5: Sign Here City or town, state, and ZIP code (c) Complete Steps 2-4 ONLY if they apply to you; otherwise, skip to Step 5. See page 2 for more information on each step, who can claim exemption from withholding, when to use the estimator at www.irs.gov/W4App, and privacy. Single or Married filing separately Married filing jointly or Qualifying widow(er) Head of household (Check only if you're unmarried and pay more than half the costs of keeping up a home for yourself and a qualifying individual.) Complete this step if you (1) hold more than one job at a time, or (2) are married filing jointly and your spouse also works. The correct amount of withholding depends on income earned from all of these jobs. Complete Steps 3-4(b) on Form W-4 for only ONE of these jobs. Leave those steps blank for the other jobs. (Your withholding will be most accurate if you complete Steps 3-4(b) on the Form W-4 for the highest paying job.) If your total income will be $200,000 or less ($400,000 or less if married filing jointly): Multiply the number of qualifying children under age 17 by $2,000 $ Multiply the number of other dependents by $500 Add the amounts above and enter the total here. (a) Other income (not from jobs). If you want tax withheld for other income you expect this year that won't have withholding, enter the amount of other income here. This may include interest, dividends, and retirement income Do only one of the following. (a) Use the estimator at www.irs.gov/W4App for most accurate withholding for this step (and Steps 3-4); or (b) Use the Multiple Jobs Worksheet on page 3 and enter the result in Step 4(c) below for roughly accurate withholding; or (b) Deductions. If you expect to claim deductions other than the standard deduction and want to reduce your withholding, use the Deductions Worksheet on page 3 and enter the result here (c) Extra withholding. Enter any additional tax you want withheld each pay period.. OMB No. 1545-0074 (c) If there are only two jobs total, you may check this box. Do the same on Form W-4 for the other job. This option is accurate for jobs with similar pay; otherwise, more tax than necessary may be withheld. O TIP: To be accurate, submit a 2022 Form W-4 for all other jobs. If you (or your spouse) have self-employment income, including as an independent contractor, use the estimator. 2022 (b) Social security number Employee's signature (This form is not valid unless you sign it.) ►Does your name match the name on your social security card? If not, to ensure you get credit for your earnings, contact SSA at 800-772-1213 or go to www.ssa.gov. Employers Employer's name and address Only For Privacy Act and Paperwork Reduction Act Notice, see page 3. First date of employment Cat. No. 10220Q Under penalties of perjury, I declare that this certificate, to the best of my knowledge and belief, is true, correct, and complete. Date 3 $ 4(a) S 4(b) $ 4(c) $ Employer identification number (EIN) Form W-4 (2022)

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 60% (10 reviews)

Employees with multiple jobs or who have a spouse who works may need to adjust their Form W4 to ensure that the correct amount of federal income tax i...View the full answer

Answered By

PALASH JHANWAR

I am a Chartered Accountant with AIR 45 in CA - IPCC. I am a Merit Holder ( B.Com ). The following is my educational details.

PLEASE ACCESS MY RESUME FROM THE FOLLOWING LINK: https://drive.google.com/file/d/1hYR1uch-ff6MRC_cDB07K6VqY9kQ3SFL/view?usp=sharing

3.80+

3+ Reviews

10+ Question Solved

Related Book For

Payroll Accounting 2023

ISBN: 9781264415618

9th Edition

Authors: Jeanette M. Landin, Paulette Schirmer

Question Posted:

Students also viewed these Business questions

-

If one spouse works longer hours does this mean that the other spouse works less hours? Test the relationship between HRS1 and SPHRS1 to answer the question.

-

Multiple choice Questions 1. Employees claim withholding allowances on Form W-4. Each withholding allowance claimed lowers their annual withholding base by what amount for calendar year 2014? a....

-

Should public employees of all types of jobs be allowed to strike?

-

Explain why a safety net can save the life of a circus performer.

-

Aspen Medical Laboratory performs comprehensive blood tests for physicians and clinics throughout the Southwest. Aspen uses a standard process-costing system for its comprehensive blood work. Skilled...

-

Why do you think the appraisal game (the one that involves the values card distribution) works so well at KGame?

-

What are the caveats to conducting t-tests on all of the individual b parameters in a multiple-regression model?

-

As a manufacturer of athletic shoes whose image, indeed performance, is widely regarded as socially responsible, you find your costs increasing. Traditionally, your athletic shoes have been made in...

-

An asset with a purchase price of $465,278 falls in the 3-year MACRS asset class. The asset will be sold at the end of a three year project for $132,547. What is the book value of the asset at the...

-

A soil element is shown in Figure 10.33. Determine the following: a. Maximum and minimum principal stresses b. Normal and shear stresses on plane AB Use Eqs. (10.3), (10.4), (10.6), and (10.7). 128...

-

Teton Tours in Evanston, Wyoming, has six employees who are paid on a biweekly basis. Calculate the net pay from the information provided for the July 16 pay date. Assume that all wages are subject...

-

The payroll accountant needs to compute net pay for the employees of Happy Crab Marketing. Place the following steps in the proper order after the determination of gross pay has been completed. a....

-

If fossil-fuel combustion continues at its present rate, then a greenhouse effect will occur. If a greenhouse effect occurs, then world temperatures will rise. Therefore, if fossil-fuel combustion...

-

What is the amount of Gain or Loss recognized on the disposition? Enter a Gain as a positive number or a Loss as a negative number or Zero if neither is recognized. R&R purchased a piece of equipment...

-

B)There is a significant increase in Machinery, Equipment, and Office Furniture (576%), a significant increase in A significant increase in the Line of Credit (344%), and a significant increase in...

-

Ryvel Company has 2 (two) Production Departments, namely Department I and Department II. In addition, it has 2 (two) Supporting Departments, namely Department C and Department D. Ryvel Company...

-

Dollars According to the graph below, what should this profit-maximizing firm do? P3 P4 MC ATC 0 Q3Q1Q2 MR D Quantity

-

Nyameye Ent. Manufactures rubber at Kurriasi. The following details relate to the movement of materials in February 2010. February Beginning balance: 800 units @ $6 per unit. 5 Received 200 units $7...

-

A bullet of mass 10 g leaves the barrel of a rifle at 300 m/s. Assuming the force on the bullet is constant while it is in the barrel, find the magnitude of this force.

-

The activities listed in lines 2125 serve primarily as examples of A) Underappreciated dangers B) Intolerable risks C) Medical priorities D) Policy failures

-

Discuss some ways that a firm can link its sales promotion activities to its advertising and personal selling effortsso that all of its promotion efforts result in an integrated effort.

-

Indicate the type of sales promotion that a producer might use in each of the following situations and briefly explain your reasons: a. A firm has developed an improved razor blade and obtained...

-

Why wouldnt a producer of toothpaste just lower the price of its product rather than offer consumers a price-off coupon?

-

(1 point) Bill makes annual deposits of $1900 to an an IRA earning 5% compounded annually for 14 years. At the end of the 14 years Bil retires. a) What was the value of his IRA at the end of 14...

-

Which of the following concerning short-term financing methods is NOT CORRECT? Short-term bank loans typically do not require assets as collateral. Firms generally have little control over the level...

-

Kingbird Corporation is preparing its December 31, 2017, balance sheet. The following items may be reported as either a current or long-term liability. 1. On December 15, 2017, Kingbird declared a...

Study smarter with the SolutionInn App