KMH Industries is a monthly schedule depositor of payroll taxes. For the month of August 2022, the

Question:

KMH Industries is a monthly schedule depositor of payroll taxes. For the month of August 2022, the payroll taxes (employee and employer share combined) were as follows:

Social Security tax: $3,252.28

Medicare tax: $760.61

Employee federal income tax: $2,520.00

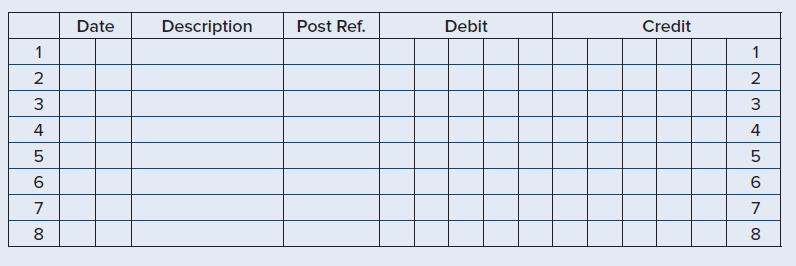

Create the General Journal entry for the remittance of the taxes. The entry should be dated September 14, 2022. Use check 2052 in the description.

Transcribed Image Text:

1 2 3 45 6 88 7 Date Description Post Ref. Debit Credit 1 2 3 4 56780

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 72% (11 reviews)

ANSWER Debit Credit Cash 653389 Payroll Tax Expense 32522...View the full answer

Answered By

Hafiz Muhammad Safdar Ali

I have been a tutor for the past 5 years. I have experience working with students in a variety of subject areas, including computer science, math, science, English, and history. I have also worked with students of all ages, from elementary school to college. In addition to my tutoring experience, I have a degree in education from a top university. This has given me a strong foundation in child development and learning theories, which I use to inform my tutoring practices.

I am patient and adaptable, and I work to create a positive and supportive learning environment for my students. I believe that all students have the ability to succeed, and it is my job to help them find and develop their strengths. I am confident in my ability to tutor students and help them achieve their academic goals.

0.00

0 Reviews

10+ Question Solved

Related Book For

Payroll Accounting 2023

ISBN: 9781264415618

9th Edition

Authors: Jeanette M. Landin, Paulette Schirmer

Question Posted:

Students also viewed these Business questions

-

KMH Industries is a monthly schedule depositor of payroll taxes. For the month of August, the payroll taxes (employee and employer share) were as follows:

-

Legends Lead works is a monthly schedule depositor of payroll taxes. For the month of April, the payroll taxes (employee and employer share) were as follows?

-

Legends Leadworks is a monthly schedule depositor of payroll taxes. For the month of April 2022, the payroll taxes (employee and employer share) were as follows: Social Security tax: $5,386.56...

-

Simplity each of the follewing ratios. f r 15 15kg:350 g 0.45:085 ( 580 ml: L121:104 m/ 40 033:063: 18

-

The enlarged circular inset in Fig. 19.11 shows how the positive sodium ions in seawater are accelerated out the rear of the submarine to provide a propulsive force. But what about the negative...

-

Sales Budget Is the following statement true or false? Since external variables (such as customer tastes and economic conditions) cannot be controlled by a company, those inputs are not used when...

-

Val is in financial difficulty, and its stockholders and creditors have requested a statement of affairs for planning purposes. The following information is available: 1. The company estimates that...

-

Alston Corporation makes rocking chairs. The chairs move through two departments during production. Lumber is cut into chair parts in the cutting department, which transfers the parts to the assembly...

-

1.5 year T-Bill yield of Pepsi company(2018 to 2022)(RF) 2.Average 5 year S&P500 of Pepsi company(Rm) 3.Beta value can you please the values of the above Pepsi co Canada I need those values to...

-

8.1 Create a one-way data table for profit at different levels of supplier contact in range B22:C33. Ensure that the price in cell C3 is $290 and the advertising budget in cell C5 is $35,000,000 (you...

-

Although the company has already established medical and retirement plan benefits, Toni Prevosti wants to consider other benefits to attract employees. As the companys accountant, you have been...

-

What is always true about the income statement? a. Only accounts with balances at the end of the period are included. b. All income and expense accounts are included in the report. c. All liabilities...

-

Explain each of the following in your own words: a percentile; the first quartile, Q1; the third quartile, Q3; and the inter quartile range, IQR.

-

Investigate the Mercedes Benz company and you have to cover this topic " For Business prospects, Market growth, Market quality, and Environmental aspects are three most important factors. Explain...

-

The case study for Goodwill Industries and how they "do good" as a core business strategy. What are Goodwill's competitive advantages? Goodwill has found success in social services. What problems...

-

Cosmic Cals (Pty) Ltd , a seller of personalized scientific calculators, had an inventory of 40 calculators. The value of these calculators is R15 400 each on the 1 January 2022. During the current...

-

Perform an analysis of Best Buy Co. Inc. Your analysis will draw on the Form 10K (as of February 2013). Your analysis can include information prior to February 2013 but should not draw on any...

-

Research organizational structure of a company of your choice. Use your understanding of organizational structure to analyze whether this organization's structure is the best choice for the business...

-

List four uses for ID-dependent entities.

-

Outline some of the major problems confronting an international advertiser.

-

Mountain Nursery Company grows a variety of plants and sells them to local nurseries. Raw materials consist of such items as seeds and the fertilizer required to grow plants from the seedling stage...

-

Carson Company produces a regular computer monitor that sells for $175 and a premium computer monitor that sells for $300. Last year, total overhead costs of $3,675,000 were allocated based on direct...

-

Provincial Company is deciding which of three approaches it should use to apply overhead to products. Information for each approach is provided in the following. ¢ One plantwide rate. The...

-

Break-Even Sales and Sales to Realize Income from Operations For the current year ending October 31, Yentling Company expects fixed costs of $537,600, a unit variable cost of $50, and a unit selling...

-

You buy a stock for $35 per share. One year later you receive a dividend of $3.50 per share and sell the stock for $30 per share. What is your total rate of return on this investment? What is your...

-

Filippucci Company used a budgeted indirect-cost rate for its manufacturing operations, the amount allocated ($200,000) is different from the actual amount incurred ($225,000). Ending balances in the...

Study smarter with the SolutionInn App