River Signorini works for New & Old Apparel, which pays employees on a semimonthly basis. Rivers annual

Question:

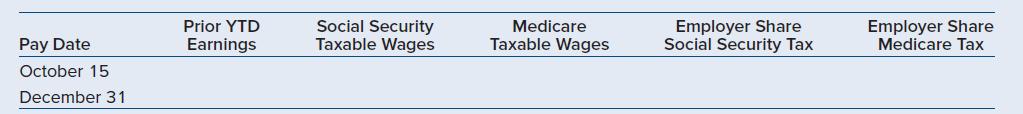

River Signorini works for New & Old Apparel, which pays employees on a semimonthly basis. River’s annual salary is $184,000. Calculate the following:

Transcribed Image Text:

Pay Date October 15 December 31 Prior YTD Earnings Social Security Taxable Wages Medicare Taxable Wages Employer Share Social Security Tax Employer Share Medicare Tax

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 60% (10 reviews)

To calculate the amounts for the payroll dates of October 15 and December 31 we need to first calcul...View the full answer

Answered By

Hafiz Muhammad Safdar Ali

I have been a tutor for the past 5 years. I have experience working with students in a variety of subject areas, including computer science, math, science, English, and history. I have also worked with students of all ages, from elementary school to college. In addition to my tutoring experience, I have a degree in education from a top university. This has given me a strong foundation in child development and learning theories, which I use to inform my tutoring practices.

I am patient and adaptable, and I work to create a positive and supportive learning environment for my students. I believe that all students have the ability to succeed, and it is my job to help them find and develop their strengths. I am confident in my ability to tutor students and help them achieve their academic goals.

0.00

0 Reviews

10+ Question Solved

Related Book For

Payroll Accounting 2023

ISBN: 9781264415618

9th Edition

Authors: Jeanette M. Landin, Paulette Schirmer

Question Posted:

Students also viewed these Business questions

-

Wolfe Industries pays its employees on a semimonthly basis. Using the wage-bracket tables from Appendix C, compute the federal income tax deductions for the following employees of Wolfe Industries:...

-

Wolfe Industries pays its employees on a semimonthly basis. Using the wagebracket tables in Appendix C, compute the federal income tax deductions for the following employees of Wolfe Industries. No...

-

Bob works for Seymour Engines, which pays employees on a semi-monthly basis. Bob's annual salary is $120,000. Calculate the following?

-

Write a function named "count the" in C which counts the number of times a given word "the" appears in the string parameter. Test Data: Input: The string where the word the present more than once....

-

The Bienestar Cardiology Clinic has two major activities: diagnostic and treatment. The two activities use four resources: nursing, medical technicians, cardiologists, and equipment. Detailed...

-

Define technical skills as a management function. LO.1

-

Random Number Table Use the seventh row of Table 1 in Appendix B to generate 12 random numbers between 1 and99.

-

Branson Industries conducts operations in five major industries, A, B, C, D, and E. Financial data relevant to each industry for the year ending December 31, 2008, are as follows: Included in the...

-

a. Briefly discuss the concept of persuasiveness as it relates to the development of modern internal audit programs. b. Distinguish between management fraud and misappropriation of assets. c. Outline...

-

In this mini-case, you will complete the test of details on accounts receivable for the 2019 audit of EarthWear Clothiers, Inc. The principal test of detail involves sending "confirmations" or...

-

Which of the following are always employer-only payroll obligations? a. Social Security tax b. SUTA c. Employee income tax d. FUTA

-

What taxes are paid only by the employer in most states?

-

Show that the vector potentials given in Eq. (27.1) imply the magnetic fields given in Eq. (27.2) by evaluating \(\boldsymbol{B}=\boldsymbol{abla} \times \boldsymbol{A}\) in the cylindrical...

-

The Penguin Textile Company sells shirts for men and boys. Results for January 2 0 2 3 are summarized below. Men's Boy's Total Revenue $ 1 7 2 , 8 0 0 $ 7 2 , 0 0 0 $ 2 4 4 , 8 0 0 Variable costs 1 2...

-

SINGLE, MARRIED FILING SEPERATELY, OR HEAD OF HOUSEHOLD SINGLE, MARRIED FILING SEPERATELY, OR HEAD OF HOUSEHOLD Over $0 $12,500 $50,000 But Not Over $12,500 $50,000 Tax Due Is 4% of taxable income...

-

17. S T D -3 -2 graph of glx) 2 The graph of the continuous function g is shown above for -46x4. The Function g is twice differentiable, except at x=0. let & be the function with flo1=-2 and f'(x) =...

-

Tim works for HydroTech, a manufacturer of high-pressure industrial water pumps. He reports directly to the CFO, and she has asked him to calculate HydroTech's WACC. He has gathered the following...

-

You are appraising a 15,450 square foot (SF) building and using the Cost Approach. The base cost is $50/SF, the local multiplier is 1.05, the current cost multiplier is 0.92. The land value is...

-

Describe similarities and differences between cultural relativism and social contract theory.

-

Why is inventory management important for merchandising and manufacturing firms and what are the main tradeoffs for firms in managing their inventory?

-

Why does social loafing occur?

-

List the strengths and weaknesses of group decisionmaking .

-

Discuss the social value of new-product development activities that seem to encourage people to discard products that are not all worn out. Is this an economic waste? How worn out is all worn out?...

-

You have just been hired as a new management trainee by Earrings Unlimited, a distributor of earrings to various retail outlets located in shopping malls across the country. In the past, the company...

-

Brief Exercise 10-6 Flint Inc. purchased land, building, and equipment from Laguna Corporation for a cash payment of $327,600. The estimated fair values of the assets are land $62,400, building...

-

"faithful respresentation" is the overriding principle that should be followed in ones prepaparation of IFRS-based financial statement. what is it? explain it fully quoting IAS. how this this...

Study smarter with the SolutionInn App