Using a search engine such as Google, Yahoo, or Bing, search the Internet for the term new-hire

Question:

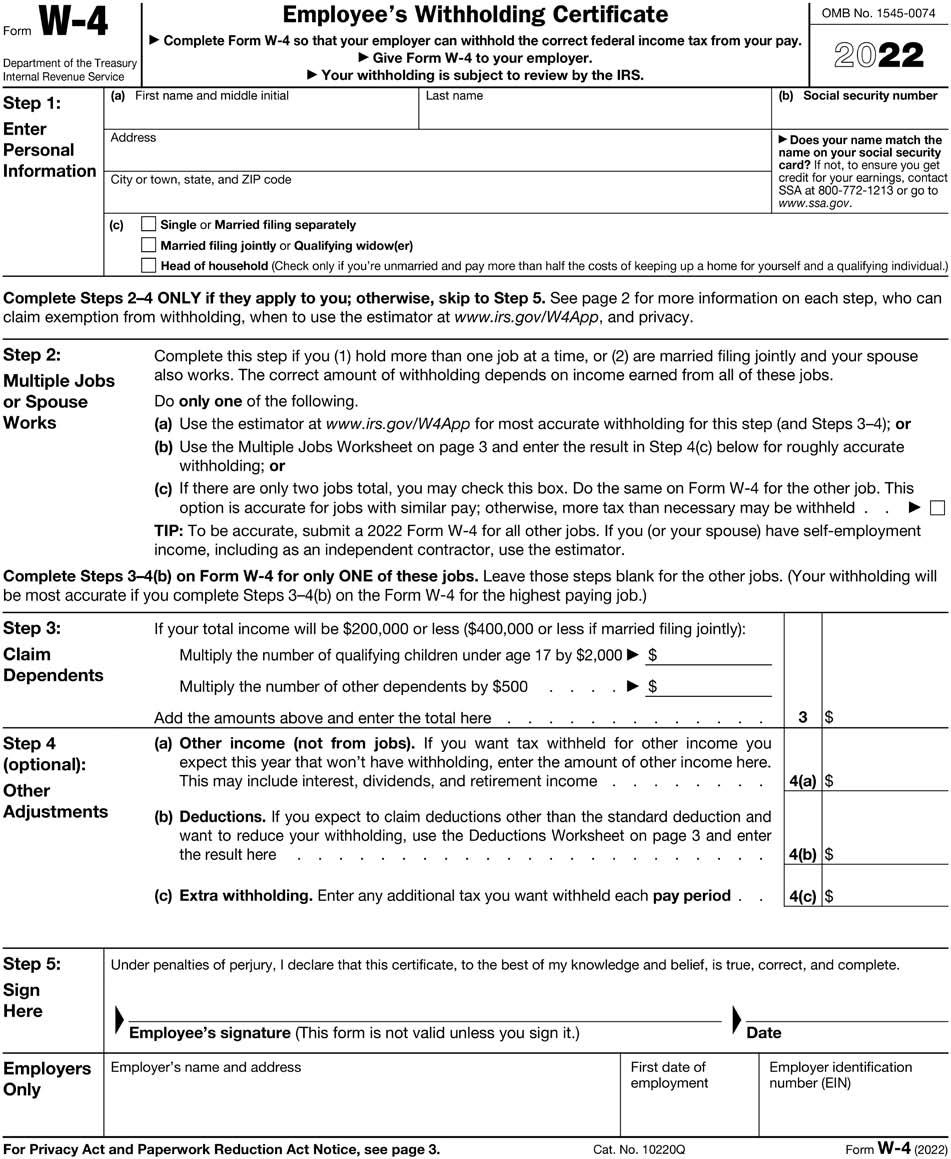

Using a search engine such as Google, Yahoo, or Bing, search the Internet for the term “new-hire packet contents.” Compile a list of the different new-hire packet items that you find in at least three companies. What are some unique items that you found on the companies’ lists? Check out the IRS’s video about determining the correct amount of withholding allowances for your Form W-4.

Transcribed Image Text:

Form W-4 Department of the Treasury Internal Revenue Service - Step 1: Enter Personal Information Step 3: Claim Dependents (a) First name and middle initial Step 4 (optional): Other Adjustments Employee's Withholding Certificate ► Complete Form W-4 so that your employer can withhold the correct federal income tax from your pay. ►Give Form W-4 to your employer. ►Your withholding is subject to review by the IRS. Last name Address Step 2: Multiple Jobs or Spouse Works Step 5: Sign Here City or town, state, and ZIP code (c) Complete Steps 2-4 ONLY if they apply to you; otherwise, skip to Step 5. See page 2 for more information on each step, who can claim exemption from withholding, when to use the estimator at www.irs.gov/W4App, and privacy. Single or Married filing separately Married filing jointly or Qualifying widow(er) Head of household (Check only if you're unmarried and pay more than half the costs of keeping up a home for yourself and a qualifying individual.) Complete this step if you (1) hold more than one job at a time, or (2) are married filing jointly and your spouse also works. The correct amount of withholding depends on income earned from all of these jobs. Do only one of the following. (a) Use the estimator at www.irs.gov/W4App for most accurate withholding for this step (and Steps 3-4); or (b) Use the Multiple Jobs Worksheet on page 3 and enter the result in Step 4(c) below for roughly accurate withholding; or Complete Steps 3-4(b) on Form W-4 for only ONE of these jobs. Leave those steps blank for the other jobs. (Your withholding will be most accurate if you complete Steps 3-4(b) on the Form W-4 for the highest paying job.) If your total income will be $200,000 or less ($400,000 or less if married filing jointly): Multiply the number of qualifying children under age 17 by $2,000 $ Multiply the number of other dependents by $500 ▶ $ (c) If there are only two jobs total, you may check this box. Do the same on Form W-4 for the other job. This option is accurate for jobs with similar pay; otherwise, more tax than necessary may be withheld .. Add the amounts above and enter the total here (a) Other income (not from jobs). If you want tax withheld for other income you expect this year that won't have withholding, enter the amount of other income here. This may include interest, dividends, and retirement income TIP: To be accurate, submit a 2022 Form W-4 for all other jobs. If you (or your spouse) have self-employment income, including as an independent contractor, use the estimator. (b) Deductions. If you expect to claim deductions other than the standard deduction and want to reduce your withholding, use the Deductions Worksheet on page 3 and enter the result here OMB No. 1545-0074 2022 (b) Social security number ► Does your name match the name on your social security card? If not, to ensure you get credit for your earnings, contact SSA at 800-772-1213 or go to www.ssa.gov. Employee's signature (This form is not valid unless you sign it.) Employers Employer's name and address Only For Privacy Act and Paperwork Reduction Act Notice, see page 3. First date of employment 4(b) S (c) Extra withholding. Enter any additional tax you want withheld each pay period. 4(c) $ . Cat. No. 10220Q Under penalties of perjury, I declare that this certificate, to the best of my knowledge and belief, is true, correct, and complete. Date 3 $ 4(a) $ Employer identification number (EIN) Form W-4 (2022)

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 70% (10 reviews)

Typically a new hire packet includes Background check and NDA documentation To verify the candidates ...View the full answer

Answered By

Carly Cimino

As a tutor, my focus is to help communicate and break down difficult concepts in a way that allows students greater accessibility and comprehension to their course material. I love helping others develop a sense of personal confidence and curiosity, and I'm looking forward to the chance to interact and work with you professionally and better your academic grades.

4.30+

12+ Reviews

21+ Question Solved

Related Book For

Payroll Accounting 2023

ISBN: 9781264415618

9th Edition

Authors: Jeanette M. Landin, Paulette Schirmer

Question Posted:

Students also viewed these Business questions

-

a. Log in to a search engine such as Yahoo or Google and search the news section to find information on recent or planned stock repurchases. What reasons have the companies given for the repurchases?...

-

Using a search engine such as Google, Yahoo, or Bing, search commission-based pay. Sites such as the Society for Human Resource Management (www.shrm.com) have many articles about commission-based pay...

-

What are some unique property features of materials bonded by metallic bonds?

-

Figure shows a current loop ABCDEFA carrying a current i = 5.00 A. The sides of the loop are parallel to the coordinate axes shown, with AB = 20.0 cm, BC = 30.0 cm, and FA = 10.0 cm. In unit vector...

-

In a balanced scorecard, a key strategic if-then statement is provided: if the number of defective units decreases, then market share will increase. Assume that the targeted reduction level of...

-

What is the role of short-term memory in conditioning? Is there a role for short-term memory in Wagners SOP model?

-

What is the conceptual relationship between the discount rates at the marketable minority (Rmm) and nonmarketable minority (Rhp) levels of value?

-

Arthur Andersen LLP was the auditor for Enron, WorldCom, Waste Management and other companies that committed fraud. Andersen was forced to shut its doors forever after a U.S. Department of Justice...

-

Currently, I have $2,500 in my bank account that pays 6% APR with monthly compounding. In order to have $12,000 in this account in 5 years, how much money should I add to this account each month...

-

CableTech Bell Corporation (CTB) operates in the telecommunications industry. CTB has two divisions: the Phone Division and the Cable Service Division. The Phone Division manufactures telephones in...

-

Kabe Oni is a part-time worker for Senior Solvers who uses company equipment in the performance of the job duties. Kabe asks the payroll supervisor, Ikino Karn, to grant independent contractor...

-

Micha Volkov is a salaried employee earning $49,850 annually. Micha is paid twice per month. Which of the following best describes the pay frequency? 1. Biweekly 2. Semimonthly 3. Weekly 4. Monthly

-

Congressman Brown supports pre-existing conditions protections introduced by the Affordable Care Act. These protections force insurers to cover health problems arising from pre-existing conditions,...

-

Based on the case, Insights Analytics: Technology for a Knowledge Management Program attached . Please explain all 8 points. Explanation of each point should be 300words . Please attach the reference...

-

When women were finally allowed to become pilots of fighter jets, engineers needed to redesign the ejection seats because they had been originally designed for men only. The ejection seats were...

-

What will be the output of the following code snippet? with open ("hello.txt", "w") as f: f.write("Hello World how are you today") with open('hello.txt', 'r') as f: data = f.readlines () for line in...

-

Assume that females have pulse rates that are normally distributed with a mean of p = 72.0 beats per minute and a standard deviation of o = 12.5 beats per minute. Complete parts (a) through (c)...

-

The proposed rates were not in the range the CEO expected given the pricing analysis. The CEO has asked the pricing actuary to verify the total projected loss cost excluding potential large storm...

-

Repeat Problem 6.101 if the tank is sealed and a pressure of 2.8 psig is above the water in the tank. Repeat Problem Compute the time required to reduce the depth in the tank shown in Fig. 6.14 by...

-

In your audit of Garza Company, you find that a physical inventory on December 31, 2012, showed merchandise with a cost of $441,000 was on hand at that date. You also discover the following items...

-

Josie is a sales representative for Talk2Me, a communications retailer based in Fort Smith, Arkansas. Josie's sales territory is Oklahoma, and she regularly takes day trips to Tulsa to meet with...

-

Kim Corporation, a calendar year taxpayer, has manufacturing facilities in States A and B. A summary of Kims property holdings follows. Determine Kims property factors for the two states assuming...

-

True Corporation, a wholly owned subsidiary of Trumaine Corporation, generated a $400,000 taxable loss in its first year of operations. True's activities and sales are restricted to State A, which...

-

Create a Data Table to depict the future value when you vary the interest rate and the investment amount. Use the following assumptions: Interest Rates: Investment Amounts:-10.0% $10,000.00 -8.0%...

-

Isaac earns a base salary of $1250 per month and a graduated commission of 0.4% on the first $100,000 of sales, and 0.5% on sales over $100,000. Last month, Isaac's gross salary was $2025. What were...

-

Calculate the price, including both GST and PST, that an individual will pay for a car sold for $26,995.00 in Manitoba. (Assume GST = 5% and PST = 8%) a$29,154.60 b$30,234.40 c$30,504.35 d$28,334.75...

Study smarter with the SolutionInn App