You are the payroll accountant for Multi Winds Energy of Cornelius, North Carolina, whose employees are paid

Question:

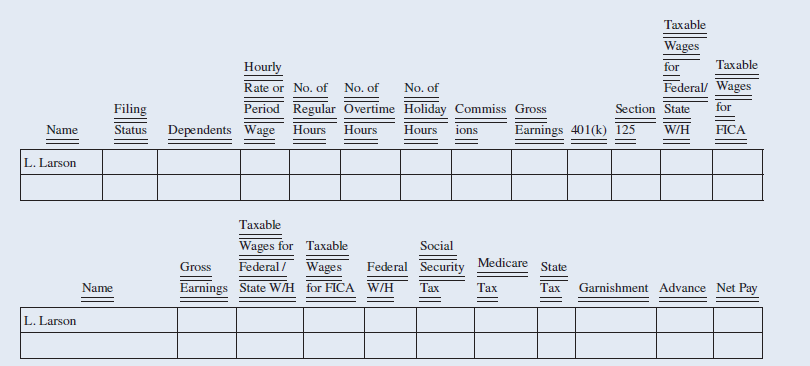

You are the payroll accountant for Multi Winds Energy of Cornelius, North Carolina, whose employees are paid biweekly. An employee, L. Larson, comes to you on September 14 and requests a pay advance of $1,000, which will be paid back in equal parts on the September 24 and October 22 paychecks. The employee is single, has no dependents, is paid $52,500 per year, contributes 5 percent of gross pay to a 401(k) plan, and has $250 per paycheck deducted for a court-ordered garnishment. Compute the net pay for the September 24 paycheck. The state income tax rate is 5.25 percent. Use the wage-bracket tables in Appendix C to determine the federal income tax withholding amount. You do not need to complete the number of hours. Assume that no pre-tax deductions exist for the employee and box 2 is not checked.

Step by Step Answer:

Payroll Accounting 2023

ISBN: 9781264415618

9th Edition

Authors: Jeanette M. Landin, Paulette Schirmer