Stan Meadows funded a trust in 2014 and named Merchants Bank as trustee. He paid no gift

Question:

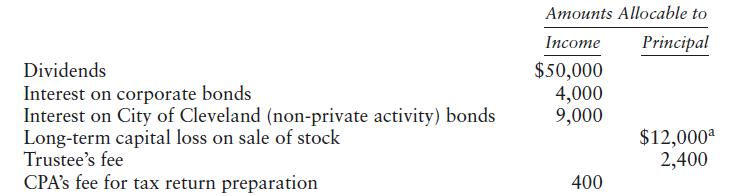

Stan Meadows funded a trust in 2014 and named Merchants Bank as trustee. He paid no gift tax on the transfer. The trustee in its discretion is to pay out income, but not principal, to Stan’s children, Angela and Barry, for 15 years. Then the trust will terminate, and its assets, including accumulated income, will be paid to Angela and Barry in equal amounts. (Separate shares are not to be maintained.) In the current year, the trustee distributes \($3,000\) to Angela and \($9,000\) to Barry. The trust paid estimated federal income taxes of \($6,000\) from the principal account and reported the following additional results for the current year. The trust instrument requires trustee’s fees to be paid from principal.

Prepare a Form 1041 for 2023, including any needed Schedule K-1s, for the trust established by Mr. Meadows. Ignore the alternative minimum tax (AMT). The trustee’s address is 201 Fifth Ave., Northeast City, NY 10000. The trust’s identification number is 74-1212121. Angela and Barry reside at 3 East 46th St., North City, NY 11000.

Step by Step Answer:

Pearsons Federal Taxation Corporations Partnerships Estates And Trusts 2024

ISBN: 9780138101787

37th Edition

Authors: Luke E. Richardson, Mitchell Franklin