You accepted a new job with starting salary of $52,000 per year. The salary is expected to increase 4% each year. Now it is

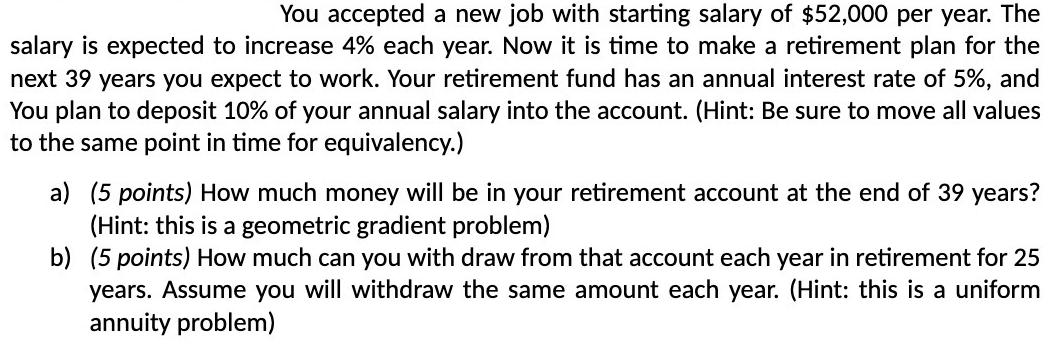

You accepted a new job with starting salary of $52,000 per year. The salary is expected to increase 4% each year. Now it is time to make a retirement plan for the next 39 years you expect to work. Your retirement fund has an annual interest rate of 5%, and You plan to deposit 10% of your annual salary into the account. (Hint: Be sure to move all values to the same point in time for equivalency.) a) (5 points) How much money will be in your retirement account at the end of 39 years? (Hint: this is a geometric gradient problem) b) (5 points) How much can you with draw from that account each year in retirement for 25 years. Assume you will withdraw the same amount each year. (Hint: this is a uniform annuity problem)

Step by Step Solution

3.41 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

a To calculate the total amount of money in the retirement account after 39 years we can use the formula for the future value of a geometric gradient ...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started