You are the CFO of Chevron. You have a blending process on a production field that needs to be immediately reengineered. The production field

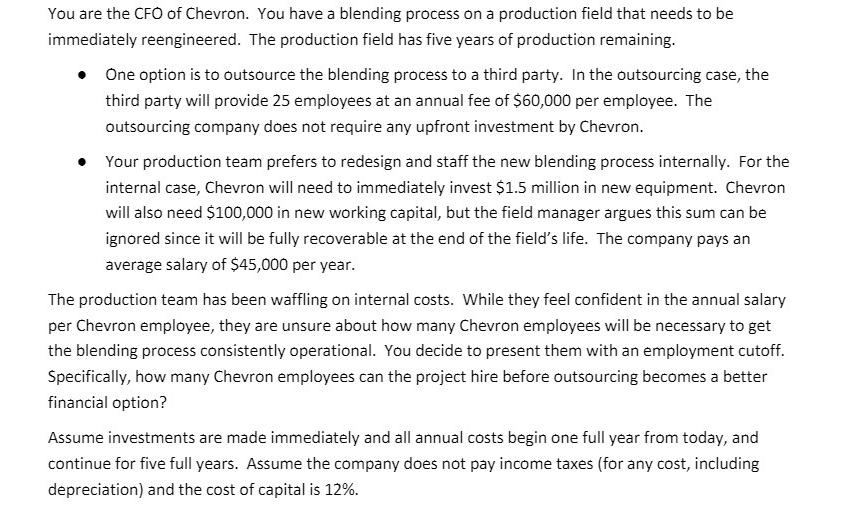

You are the CFO of Chevron. You have a blending process on a production field that needs to be immediately reengineered. The production field has five years of production remaining. One option is to outsource the blending process to a third party. In the outsourcing case, the third party will provide 25 employees at an annual fee of $60,000 per employee. The outsourcing company does not require any upfront investment by Chevron. Your production team prefers to redesign and staff the new blending process internally. For the internal case, Chevron will need to immediately invest $1.5 million in new equipment. Chevron will also need $100,000 in new working capital, but the field manager argues this sum can be ignored since it will be fully recoverable at the end of the field's life. The company pays an average salary of $45,000 per year. The production team has been waffling on internal costs. While they feel confident in the annual salary per Chevron employee, they are unsure about how many Chevron employees will be necessary to get the blending process consistently operational. You decide to present them with an employment cutoff. Specifically, how many Chevron employees can the project hire before outsourcing becomes a better financial option? Assume investments are made immediately and all annual costs begin one full year from today, and continue for five full years. Assume the company does not pay income taxes (for any cost, including depreciation) and the cost of capital is 12%.

Step by Step Solution

3.41 Rating (167 Votes )

There are 3 Steps involved in it

Step: 1

To determine the employment cutoff point at which outsourcing becomes a better financial option we n...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started