Go to the website www.caringinfo.org/stateaddownload and download a copy of the forms that are appropriate for your

Question:

Go to the website www.caringinfo.org/stateaddownload and download a copy of the forms that are appropriate for your state. Discuss the forms with your family members and give serious thought to how to complete the documents. First ask permission to have this conversation, because people cope with this discussion differently. Make a decision on how you would want to be treated if you were faced with a life-limiting illness. Let your family know your choices and tell them who you have named as your health care decision maker.

Your medical power of attorney should be someone you trust, such as a close family member or good friend who understands your wishes. Make sure this person is comfortable and confident about the type of medical care you want to receive.

You can also select a second agent as an alternate in case your first person is unavailable.

It is very important you use advance directive forms specifically created for your state so that they are legal. Read the forms carefully and make sure you follow the legal requirements determined by your state. You may need to have a witness signature and get the forms notarized (signed by a notary public).

Keep your completed advance directives in an easily accessible place and give photocopies to your primary medical power of attorney and your secondary, alternate agent. Contact your local hospital and doctor and ask that they file a copy of your advance directives in your medical record. This document stays in effect unless you cancel it or decide to complete a new one with changes.

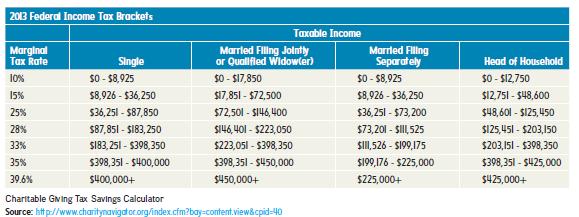

16.5 CHARITABLE GIVING TAX SAVINGS CALCULATOR (WEB ACTIVITY)

To find out your tax savings on charitable giving, go to Charity Navigator (www.charitynavigator.org/index.cfm?bay=content

.view&cpid=40) and enter the amount you’d like to give and your federal tax bracket (using the displayed chart at the site).

The calculator will display the net cost of the donation and your tax savings. What benefits does knowing this information provide? Do you keep receipts of your charitable giving today? If not, make a plan to start.

Step by Step Answer:

Personal Finance Building Your Future

ISBN: 9780077861728

2nd Edition

Authors: Robert Walker, Kristy Walker