Part A. Indicate whether each of the six items above would increase, decrease, or have no effect

Question:

Part A. Indicate whether each of the six items above would increase, decrease, or have no effect on Ted’s net income. What would be the total value of this increase or decrease?

Part B. Based on the information provided in the case and in the chapter reading, indicate whether or not Ted likely qualifies for each of the following six non-refundable tax credits: basic personal amount, spousal or common-law partner amount, age amount, CPP contributions, EI premiums, and the tuition amount?

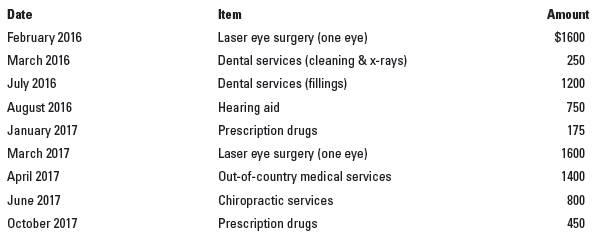

In addition, Ted provided you with a list of unclaimed eligible medical expenses for 2016 and 2017. Ted would like you to help him figure out how to determine which medical expenses he can claim on his 2017 tax return. NOTE: Ted can claim eligible medical expenses in any 12-month period ending in 2017 and not claimed for 2017. As shown in Exhibit 4.5, the amount of the claim is the amount paid in excess of 3 percent of net income or $2268, whichever is less. Ted had a net income of $75 000 in 2017.

Your investment client, Ted Burns, is a 55-year-old service manager for a car dealership. Ted has asked you for advice on preparing his 2017 tax return. Since you do not regularly prepare tax returns, you have referred Ted to a good accountant. However, you will work closely with the accountant on Ted’s tax situation. Ted tells you that he received a lump-sum bonus of $15 000 from his employer at the end of 2017. In addition, Ted owns some Canada Savings Bonds on which he earned, but did not receive, interest income of $2000 during the 2017 taxation year. Ted has been divorced since 2012. The divorce agreement, which was also reached in 2012, requires him to make annual child and spousal support payments in the amounts of $6000 and $3000, respectively. In addition, Ted pays tuition for his oldest child, who is in her first year of college. Ted’s children live with his ex-spouse. Ted rents a safety deposit box at his bank which costs him $120 per year. Ted also made a $5000 RRSP contribution in 2017.

Step by Step Answer: