Burt and Emily Gordon are a married couple in their mid-20s. Burt has a good start as

Question:

Burt and Emily Gordon are a married couple in their mid-20s. Burt has a good start as a bank manager and Emily works as a sales representative. Since their marriage 4 years ago, Burt and Emily have been living comfortably. Their income has exceeded their expenses, and they have accumulated an enviable net worth. This includes the $10,000 that they have built up in savings and investments. Because their income has always been more than enough for them to have the lifestyle they desire, the Gordons have done no financial planning.

Emily has just learned that she’s 2 months pregnant. She’s concerned about how they’ll make ends meet if she quits work after their child is born. Each time she and Burt discuss the matter, he tells her not to worry because “we’ve always managed to pay our bills on time.” Emily can’t understand his attitude, because her income will be completely eliminated. To convince Emily there’s no need for concern, Burt points out that their expenses last year, but for the common stock purchase, were about equal to his take-home pay. With an anticipated promotion to a managerial position and an expected 10% pay raise, his income next year should exceed this amount. Burt also points out that they can reduce luxuries (trips, recreation, and entertainment) and can always draw down their savings or sell some of their stock if they get in a bind. When Emily asks about the long-run implications for their finances, Burt says there will be “no problems” because his boss has assured him that he has a bright future with the bank. Burt also emphasizes that Emily can go back to work in a few years if necessary.

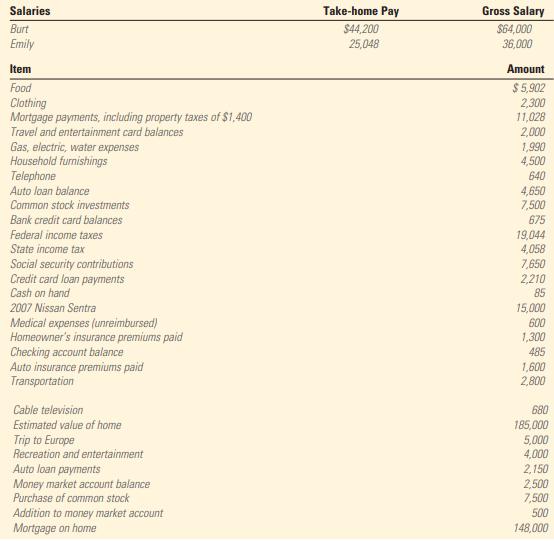

Despite Burt’s arguments, Emily feels that they should carefully examine their financial condition in order to do some serious planning. She has gathered the following financial information for the year ending December 31, 2010.

Critical Thinking Questions

1. Using this information and Worksheets 2.1 and 2.2, construct the Gordons’ balance sheet and income and expense statement for the year ending December 31, 2010.

2. Comment on the Gordons’ financial condition regarding (a) solvency,

(b) liquidity,

(c) savings,

(d) ability to pay debts promptly.

If the Gordons continue to manage their finances as described, what do you expect the long-run consequences to be? Discuss.

3. Critically evaluate the Gordon’s approach to financial planning. Point out any fallacies in Burt’s arguments, and be sure to mention

(a) implications for the long term as well as

(b) the potential impact of inflation in general and specifically on their net worth.

What procedures should they use to get their financial house in order? Be sure to discuss the role that long- and short-term financial plans and budgets might play.

Step by Step Answer:

Personal Financial Planning

ISBN: 9781439044476

12th Edition

Authors: Lawrence J. Gitman, Michael D. Joehnk, Randy Billingsley