Use Worksheet 6.1. Beverly Smitham is evaluating her debt safety ratio. Her monthly take-home pay is $3,320.

Question:

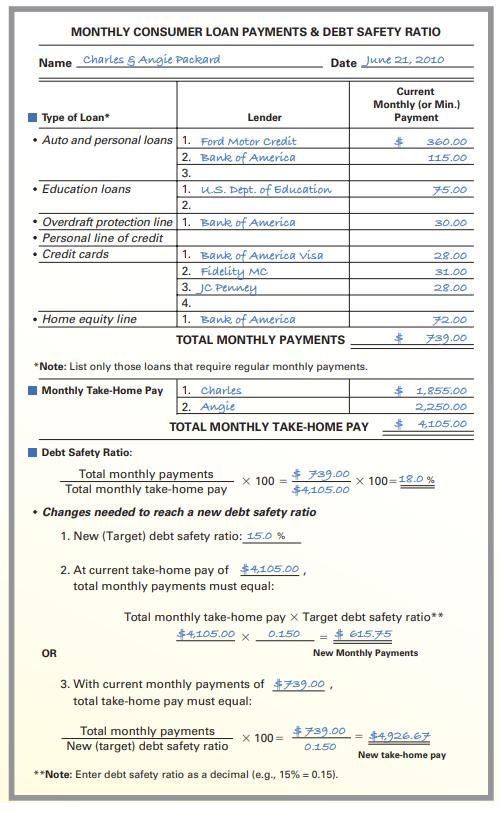

Use Worksheet 6.1. Beverly Smitham is evaluating her debt safety ratio. Her monthly take-home pay is $3,320. Each month, she pays $380 for an auto loan, $120 on a personal line of credit, $60 on a department store charge card, and $85 on her bank credit card. Complete Worksheet 6.1 by listing Beverly’s outstanding debts, and then calculate her debt safety ratio. Given her current take-home pay, what is the maximum amount of monthly debt payments that Beverly can have if she wants her debt safety ratio to be 12.5%? Given her current monthly debt payment load, what would Beverly's take-home pay have to be if she wanted a 12.5% debt safety ratio?

Worksheet 6.1

Step by Step Answer:

Personal Financial Planning

ISBN: 9781439044476

12th Edition

Authors: Lawrence J. Gitman, Michael D. Joehnk, Randy Billingsley