Question: Continuing problem 6, use the financial statements and the following list of assumptions to construct the firms pro forma financial statements for 2019. a. What

Continuing problem 6, use the financial statements and the following list of assumptions to construct the firm’s pro forma financial statements for 2019.

a. What is Green Staples’s projected short-term debt financing in 2019? How does this number compare with the 2018 figure?

b. Perform a sensitivity analysis on the short-term debt requirement projection by considering each of the following changes:

• What would happen if sales increase by 14 percent instead of 11 percent?

• What if selling, general, and administrative expenses decline from 12.3 percent to 11.0 percent of sales?

• What would be the impact of an increase of days of inventory to sixty-three days?

Problem 6

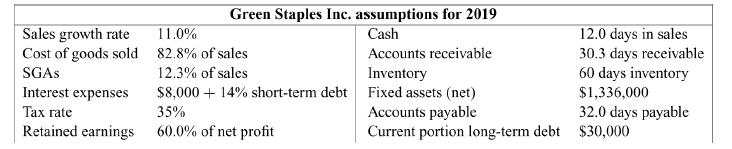

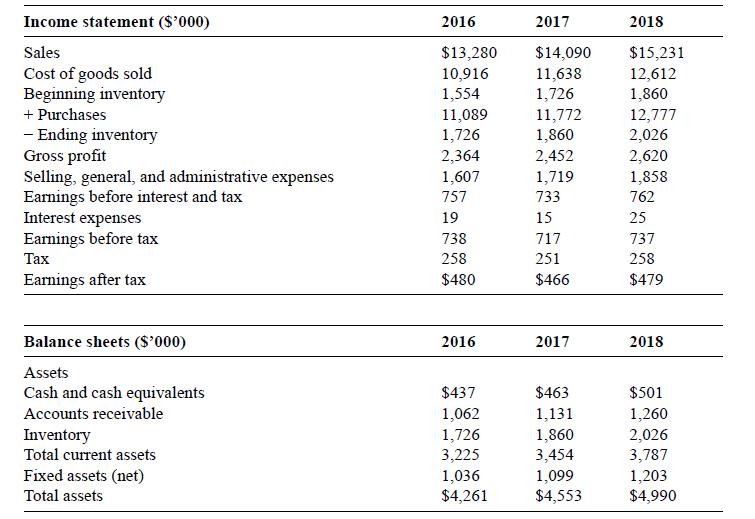

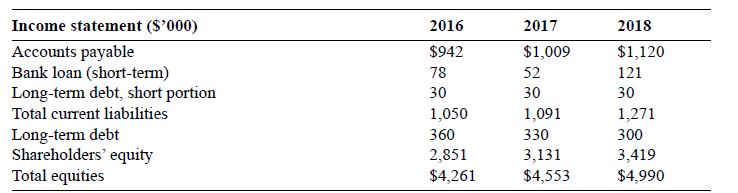

The management of Green Staples Inc., a wholesale distributor of office supplies on the East Coast of the United States, is in the process of developing the firm’s financial plans for year 2019. The company has met its goal of expanding its market coverage, having increased its 2018 sales by 8.1 percent, a growth much higher than the industry average. The management believes that 2019 will bring opportunities for further expansion, as one of the local key players is preparing to exit the market (due to the owner’s retirement). However, they also understand that they need to secure in advance the necessary financing sources in order to prudently meet the new target of 11 percent sales growth in 2019. The following charts show the company’s year-end financial statements for the last three years.

Green Staples Inc. assumptions for 2019 Sales growth rate Cost of goods sold SGAS Interest expenses Tax rate 11.0% Cash 82.8% of sales 12.3% of sales Accounts receivable Inventory $8,000+14% short-term debt Fixed assets (net) 35% Accounts payable Retained earnings 60.0% of net profit 12.0 days in sales 30.3 days receivable 60 days inventory $1,336,000 32.0 days payable Current portion long-term debt $30,000

Step by Step Solution

3.45 Rating (152 Votes )

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts