Question: Go back to problem 6. For the sake of simplicity lets assume that the entire manufacturing overhead cost is fixed. This assumption is quite reasonableat

Go back to problem 6. For the sake of simplicity let’s assume that the entire manufacturing overhead cost is fixed. This assumption is quite reasonable—at least in the short-term—given that the largest portion of this cost entails salaries. If CardioMed’s sales in the given accounting period consisted of 198,000 units of Model A and 122,000 units of Model B, and the company’s operating expenses were equal to \($14.5\) million:

a. What would be CardioMed’s net operating income under absorption costing with direct labor as allocation base?

b. What would be CardioMed’s operating income under direct costing?

Please briefly explain how you would use the additional insight provided by direct costing if you were managers in CardioMed.

Problem 6

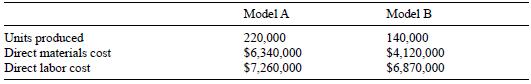

CardioMed Inc. is a manufacturer of wearable heart monitoring products that automatically detect, record, and transmit abnormal heart rhythms for up to thirty days. In one accounting period the firm produced in its plant in San Jose, California, 220,000 units of model A and 140,000 units of model B. The selling prices of models A and B are respectively \($160\) and \($190,\) while the direct costs for the period are shown in the table below:

If total manufacturing overhead expenses for the same period have been equal to \($14,460,000,\) what would be the unit cost and gross profit margin per model if the company uses an allocation rule based on (a) the proportion of each product over the total output (in units) and (b) the proportion of direct labor costs used by each product. Which allocation basis do you think is more representative of the actual overhead consumption of the two models? Please explain briefly.

Units produced Direct materials cost Direct labor cost Model A 220,000 $6,340,000 Model B 140,000 $4,120,000 $7,260,000 $6,870,000

Step by Step Solution

3.45 Rating (161 Votes )

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts