1. Assume that Pacific National Bank remains with human tellers only. a. For each time period in...

Question:

1. Assume that Pacific National Bank remains with human tellers only.

a. For each time period in Table 13.4, deter-mine the minimum number of tellers needed on station to service the customer stream.

b. Assume that the number of tellers found in part a is used. For each time period, deter-mine the mean customer waiting time.

c. For each time period, determine the mean customer waiting time when the number of tellers is one more than found in part a.

2. Past experience shows that the drop-off in clientele due to waiting translates into an expected NPV in lost future profits of $0.10 per minute. For each time period in Table 13.4, determine the average hourly queueing system cost (server cost + waiting cost), assuming that the bank uses the following service arrangement:

a. The minimum number of human tellers necessary to service the arriving customers

b. One teller more than was found in part a of Question 1

3. Suppose that the ATM is installed and that customers themselves decide whether to use human tellers or to use the ATM, and that two queues form independently for each. Finally, assume that a 10% traffic increase is generated by the ATM within each open time period and that all of it is for the ATM.

a. For each period in Table 13.4, determine the mean arrival rate at the human teller windows.

b. Do the same with regard to the mean arrival rate at the ATM.

c. Find the minimum number of human tellers required to be on station during each time period.

4. Assume that the number of human tellers used is one more than that found in part c of Question 3. Determine for Ms. Meisterhaus the mean customer waiting time during each open period in Table 13.4 for those customers who seek the following:

a. Human tellers

b. Access to the ATM

5. The hourly cost of maintaining and operating the ATM is $5. Increased customer traffic results in additional bank profit estimated to be $0.20 per transaction. Determine for Ms. Meisterhaus the net hourly queueing system cost, reflecting any profit increase, for operating with the ATM for each of the four periods identified in Table 13.4. Use the mean waiting times from Question 4.6. Consider the complete 24-hour, 7-day picture. Incorporate whatever information you need from Questions 1 through 5 and your solutions, plus any additional information in the case and any necessary assumptions, to compare the net cost of operation with and without the ATM. Then give your overall recommendation to Ms. Meisterhaus.

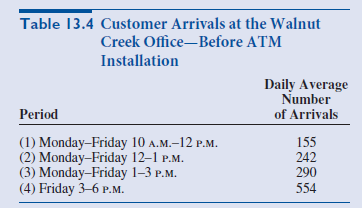

Table 13.4:

Pacific National Bank is a medium-size bank with 21 branches in the San Francisco Bay Area. Until very recently, Pacific did not operate its own ATMs; instead, it relied on an outside vendor to operate them. Ninety percent of the ATM customers obtained cash advances with non-Pacific credit cards, so the ATMs did little to directly improve Pacific's own banking business. Operations Vice President Nancy Meisterhaus wants to change that, by having Pacific offer a broader mix of banking services with its own machines tied into its own data-processing network.

The industry consensus is that the ATM appeals to customers in much the same way as the super-market express line: It minimizes the amount of waiting. But for Pacific, the 24-hour ATM would also have the broader appeal of providing essential banking services at all hours, reaching a segment of the market not currently served. Historically, customers who find standard banking hours inconvenient have been lost to Pacific, so the ATM will increase the bank's market share.

Besides attracting more customers and servicing existing customers better, the ATM operation should offer substantial cost advantages. Fewer human tellers would be required for the same volume of transactions as before. The per transaction cost of the machine, which does need some human attention for restocking and maintenance, should be substantially less. But even if that were not so, its 24-hour readiness would be extremely expensive to duplicate with human tellers, who would have to be given extra protection for dangerous late-night work.

Ms. Meisterhaus selected the Walnut Creek office as the test branch for a captive ATM. Customers from that branch were recruited to sign up for a Pacific ATM card. All residents within the neighboring ZIP codes were offered an incentive to open free checking accounts at Pacific when they also signed up for the card. After a critical mass of ATM card holders was established'but before the banking ATM was installed'statistics were kept. The arrival times in Table 13.4 were determined for various times of the week.

The bank opens at 10 A.M. and closes at 3 P.M., except on Friday, when it closes at 6 P.M. Past study shows that, over each period, customers arrive randomly at a stable mean rate, so the assumption of a Poisson process is valid. The mean time required to complete customer transactions is two minutes, and the individual service times have a frequency distribution with a pronounced positive skew, so an exponential distribution is a reasonable approximation to reality.

Tellers all work part-time and cost $10 per bank hour. Pacific's experience has established that there will be a significant drop-off in clientele soon after a bout when customers suffer lengthy delays in getting teller access. The supplier of the ATM equipment claims that other banks of comparable size have experienced a 30% diversion of regular business away from human tellers to the ATM, which produced a further 20% expansion beyond the previous level of overall client transactions'all absorbed by the ATM, half of it outside regular banking hours. The supplier also maintains that ATM traffic is fairly uniform, except between 11 P.M. and 6 A.M., when it is negligible. Ms. Meisterhaus believes that the ATM busy-period arrivals will constitute a single Poisson process. Industry experience is that the mean service time at an ATM is one-half minute, with an exponential distribution serving as an adequate approximation to the unknown positively skewed unimodal distribution that actually applies. Ms. Meisterhaus believes that once the ATM is installed the Walnut Creek human tellers will be left with a greater proportion of the more involved and lengthy transactions, raising their mean service time to 2.5 minutes.

Ms. Meisterhaus knows that much of the evaluation of the ATM operations will be a queueing exercise. Her knowledge of this subject is a bit rusty, so she has retained you to assist her.

The word "distribution" has several meanings in the financial world, most of them pertaining to the payment of assets from a fund, account, or individual security to an investor or beneficiary. Retirement account distributions are among the most...

Step by Step Answer: