Answered step by step

Verified Expert Solution

Question

1 Approved Answer

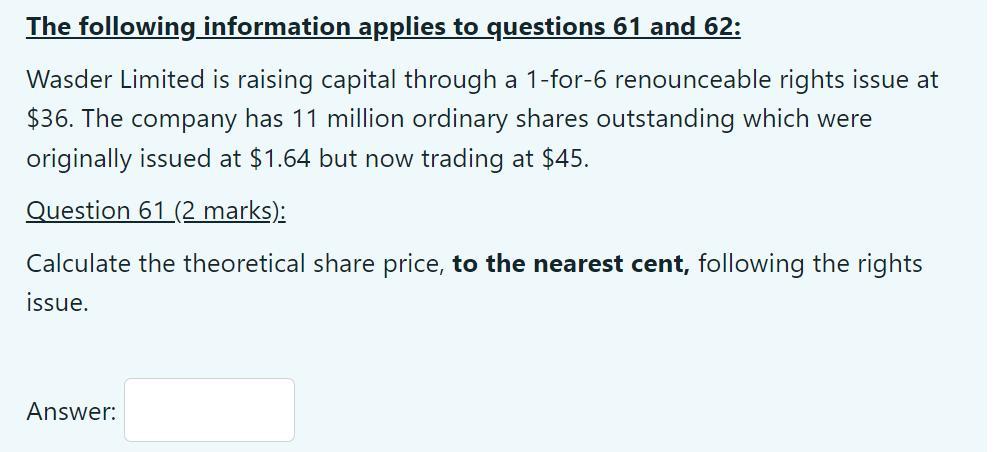

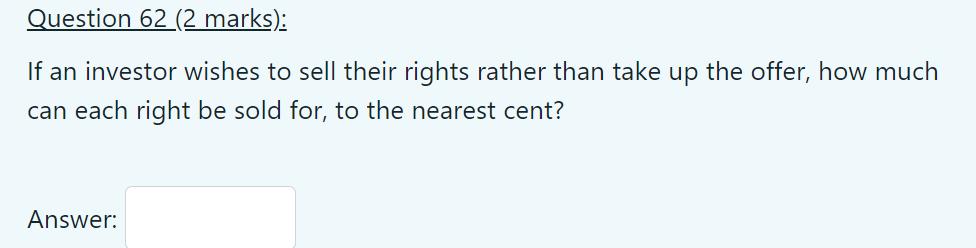

The following information applies to questions 61 and 62: Wasder Limited is raising capital through a 1-for-6 renounceable rights issue at $36. The company

The following information applies to questions 61 and 62: Wasder Limited is raising capital through a 1-for-6 renounceable rights issue at $36. The company has 11 million ordinary shares outstanding which were originally issued at $1.64 but now trading at $45. Question 61 (2 marks): Calculate the theoretical share price, to the nearest cent, following the rights issue. Answer: Question 62 (2 marks): If an investor wishes to sell their rights rather than take up the offer, how much can each right be sold for, to the nearest cent? Answer:

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To calculate the theoretical share price following the rights issue we first need to determine the total number of new shares issued and the total num...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started