Questions 3-4 refer to the following passage. It can be inferred from the passage that the author

Question:

Questions 3-4 refer to the following passage.

It can be inferred from the passage that the author considers the Nielsen Company’s techniques

a. Intentionally biased

b. Dubious

c. Worthless

d. Unscrupulous

e. Overly boastful

Transcribed Image Text:

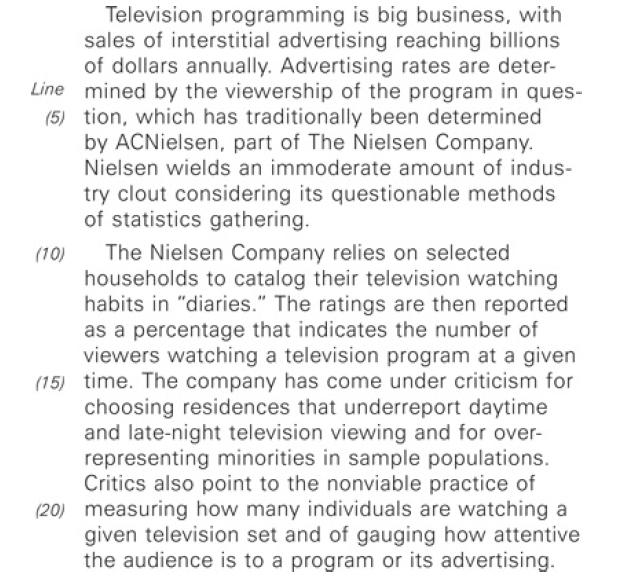

Television programming is big business, with sales of interstitial advertising reaching billions of dollars annually. Advertising rates are deter- Line mined by the viewership of the program in ques- (5) tion, which has traditionally been determined by ACNielsen, part of The Nielsen Company. Nielsen wields an immoderate amount of indus- try clout considering its questionable methods of statistics gathering. The Nielsen Company relies on selected households to catalog their television watching habits in "diaries." The ratings are then reported as a percentage that indicates the number of viewers watching a television program at a given (15) time. The company has come under criticism for choosing residences that underreport daytime and late-night television viewing and for over- representing minorities in sample populations. Critics also point to the nonviable practice of (20) measuring how many individuals are watching a given television set and of gauging how attentive the audience is to a program or its advertising. (10)

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 71% (7 reviews)

B The author says the Nielsen Company has questionable ...View the full answer

Answered By

Asim farooq

I have done MS finance and expertise in the field of Accounting, finance, cost accounting, security analysis and portfolio management and management, MS office is at my fingertips, I want my client to take advantage of my practical knowledge. I have been mentoring my client on a freelancer website from last two years, Currently I am working in Telecom company as a financial analyst and before that working as an accountant with Pepsi for one year. I also join a nonprofit organization as a finance assistant to my job duties are making payment to client after tax calculation, I have started my professional career from teaching I was teaching to a master's level student for two years in the evening.

My Expert Service

Financial accounting, Financial management, Cost accounting, Human resource management, Business communication and report writing. Financial accounting : • Journal entries • Financial statements including balance sheet, Profit & Loss account, Cash flow statement • Adjustment entries • Ratio analysis • Accounting concepts • Single entry accounting • Double entry accounting • Bills of exchange • Bank reconciliation statements Cost accounting : • Budgeting • Job order costing • Process costing • Cost of goods sold Financial management : • Capital budgeting • Net Present Value (NPV) • Internal Rate of Return (IRR) • Payback period • Discounted cash flows • Financial analysis • Capital assets pricing model • Simple interest, Compound interest & annuities

4.40+

65+ Reviews

86+ Question Solved

Related Book For

1014 Practice Questions For The New GRE

ISBN: 9780375429682

2nd Edition

Authors: The Princeton Review

Question Posted:

Students also viewed these Business questions

-

Refer to Exercise 12.12. In the plot of the data, airport 20 had a much larger revenue than any of the other 21 airports. a. Replot the three scatterplots with the data from airport 20 deleted. Does...

-

The problems in this problem set refer to the following game matrices. In each case, Jack chooses left or right and Jill chooses up or down. The outcomes show how many buckets of water are rewarded....

-

Questions 7-8 refer to the following passage. Consider each of the choices separately and select all that apply. It can be inferred from the passage that the author would be most likely to agree with...

-

Analyze the case study, "Frank Smith Plumbing." Analyze the "Frank Smith Plumbing's Financial Statement" spreadsheet. Compare the cost of the truck to the cash flow records Compile your calculations...

-

A light truck is purchased on January 1 at a cost of $35,000. It is expected to serve for eight years and have a salvage value of $5,000. Calculate the depreciation expense for the first and third...

-

You are a new manager at K & J Brick, a masonry products company that is now run by the two sons of the man who founded it 50 years ago. For years, the co-owners have invited the management team to a...

-

Define expert systems, If/Then rules, and expert systems shell. Explain how expert system rules are created. Summarize the three major disadvantages of expert systems, and assess the future of these...

-

As the auditor of Clearwater County you learn that various assets are subject to spending constraints. Indicate how each of the following constraints would affect the countys reported fund balance...

-

Pittman Company is a small but growing manufacturer of telecommunications equipment. The company has no sales force of its own; rather, it relies completely on independent sales agents to market its...

-

Trust your doctor: The General Social Survey recently surveyed people to ask, How much would you trust your doctor to put your health above costs? The following relative frequency bar graph presents...

-

Questions 3-6 refer to the following passage. The author refers to James Fenimore Cooper and Willa Cather in order to suggest a. That their works are examples of entertaining literature b. That their...

-

Questions 3-6 refer to the following passage. Select the sentence that shows the authors view of McMurtrys treatment of gender. The literature of the American West ranges from lowbrow entertainment...

-

Use the following results of a coffee taste test given at a local mall. If one of these individuals is selected at random, determine the probability the individual selected. Prefers Manhattans Finest...

-

An employer has calculated the following amounts for an employee during the last week of June 2021. Gross Wages $1,800.00 Income Taxes $414.00 Canada Pension Plan $94.00 Employment Insurance $28.00...

-

Section Two: CASE ANALYSIS (Marks: 5) Please read the following case and answer the two questions given at the end of the case. Zara's Competitive Advantage Fashion houses such as Armani and Gucci...

-

The activity of carbon in liquid iron-carbon alloys is determined by equilibration of CO/CO2 gas mixtures with the melt. Experimentally at PT = 1 atm, and 1560C (1833 K) the equilibrated gas...

-

Apply knowledge of concepts and theories covered in the course to leader - the leader can either be themselves if they lead a team, someone real and personally known to them (such as a boss or leader...

-

A resistor in a dc circuit R = 1.2 2. The power dissipated P is a second-degree function of the voltage V. Graph P versus V from V = 0.0 V to V = 3.0 V.

-

According to ASA500 'Audit Evidence' - the auditor should obtain sufficient appropriate audit evidence on which to base their audit opinion. Required: For each audit procedure listed below, indicate:...

-

Nate prepares slides for his microscope. In 1 day he prepared 12 different slides. Which equation best represents y, the total number of slides Nate prepares in x days if he continues at this rate? A...

-

The isosceles triangle below has one angle measure as shown. What is the measure of each of the other angles? F. 30 G. 45 H. 50 J. 65 K. 130 50

-

In the figure shown below, AD = 16, ED = 11, and AE is congruent to CD. What is the length of AB? F. 5 G. 52 H. 6 J. 112 K. 25 A B E C D

-

2r/3 + 4s/5 is equivalent to: F. 2r + 4s/8 G. 2r + 4s/15 H. 2(r + 2s)/15 J. (10r + 12s)/15 K. 2(10r + 12s)/15

-

Question 24 Miami Company sold merchandise for which it received $710,400, including sales and excise taxes. All of the firms sales are subject to a 6% sales tax but only 50% of sales are subject to...

-

f the IRS intends to close a Taxpayer Assistance Center, they must notify the public at least _____ days in advance of the closure date. 14 30 60 90

-

A company is evaluating a new 4-year project. The equipment necessary for the project will cost $3,300,000 and can be sold for $650,000 at the end of the project. The asset is in the 5-year MACRS...

Study smarter with the SolutionInn App