1. Suppose it is November 2000 and we are considering a government bond. We see in The...

Question:

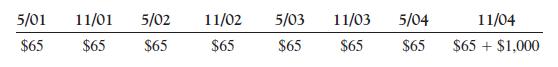

1. Suppose it is November 2000 and we are considering a government bond. We see in The Wall Street Journal some 13s of November 2004. This is jargon that means the annual coupon rate is 13 percent.1 The face value is $1,000, implying that the yearly coupon is $130 (13% $1,000). Interest is paid each May and November, implying that the coupon every six months is $65 ($130/2). The face value will be paid out in November 2004, four years from now. By this we mean that the purchaser obtains claims to the following cash flows:

If the stated annual interest rate in the market is 10 percent per year, what is the present value of the bond?

Step by Step Answer:

Corporate Finance

ISBN: 9780071229036

6th International Edition

Authors: Stephen Ross, Randolph Westerfield, Jeffrey Jaffe