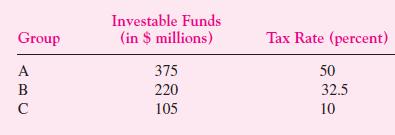

16.20 Assume that there are three groups of investors with the following tax rates and investable funds:

Question:

16.20 Assume that there are three groups of investors with the following tax rates and investable funds:

Each group requires a minimum after-tax return of 8.1 percent on any security. The only types of securities available are common stock and perpetual corporate bonds. Income from corporate bonds is subject to a personal tax, but it is deductible for corporate tax purposes. Capital gains from common stock are untaxed at the personal level. In equilibrium, common stock yields an 8.1 percent pretax return; foreign real estate also earns this rate. All funds not invested in stocks or bonds will be invested in foreign real estate. Assume the common stock and the bonds are both risk-free.

Corporate earnings before interest and taxes total $85 million each year in perpetuity. The corporate tax rate is 35 percent.

a. What is the equilibrium market rate of interest on corporate bonds, rB?

b. In equilibrium, what is the composition of each of the groups’ portfolios?

c. What is the total market value of all companies?

d. What is the total tax bill?

Step by Step Answer:

Corporate Finance

ISBN: 9780071229036

6th International Edition

Authors: Stephen Ross, Randolph Westerfield, Jeffrey Jaffe