16.18 The management of New England Textile Corporation (NETC) has decided to relocate the firm to North

Question:

16.18 The management of New England Textile Corporation (NETC) has decided to relocate the firm to North Carolina after four more years of operating its factory in Cotton Mather, Massachusetts. Because of transportation costs and a nonexistent secondary market for used textile machines, all of NETC’s machines will be worthless after four years.

Mr. Rayon, plant engineer, recommends that a Spool Pfitzer machine be purchased.

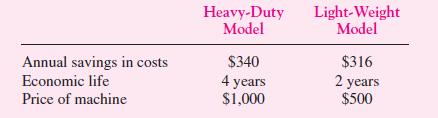

His analysis of the only two available models shows that:

NETC’s accountant, Mr. Wool, must decide on two actions.

a. Purchase the Heavy-Duty Spool Pfitzer now, or

b. Purchase one Light-Weight Spool Pfitzer now and replace it after two years with a second Light-Weight Spool Pfitzer.

The manufacturer of the Spool Pfitzers is willing to guarantee that the prices he charges to NETC won’t change during the next four years. The annual cost savings are known with certainty because of NETC’s backlog of orders to supply the Slobovian Army and because of NETC’s long-term contracts with its workers and suppliers. Only straight-line depreciation over their economic life is allowed for Spool Pfitzer machines. NETC’s tax rate is 34 percent.

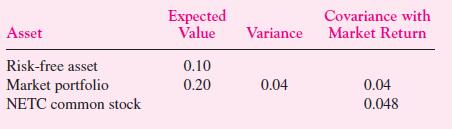

Mr. Wool, being a sophisticated USC MBA, obtained the following information for his analysis of various investment and financial proposals:

As a matter of company policy, NETC has never borrowed in the past; it is 100 percent equity financed. The market value of NETC common stock is $10 million.

a. What is the cost of capital for NETC?

b. Which of the two Spool Pfitzers should NETC purchase? If Spool Pfitzers are a bad investment, show why.

c. Assuming that the Heavy-Duty Spool Pfitzer will be purchased, what is the minimum annual savings in costs necessary for the Heavy-Duty Spool Pfitzer to be an acceptable investment?

d. Mr. Wool has long believed that NETC’s capital structure is not optimal; however, he was afraid to suggest changing the company’s traditional all-equity financing policy. He believes in the Miller-Modigliani analysis and thinks that by selling $2 million of 10 percent perpetual bonds (no maturity) at par (“par” “face” or “principal” amount) and using the proceeds to repurchase NETC stock, the total value of the firm would increase.

If Mr. Wool is correct and if his financial plan is adopted, what would be the new:

i. Total value of the firm ii. Total value of NETC stock iii. Weighted average cost of capital for NETC

e. Ms. Nylon says that Mr. Wool is mistaken. Because NETC is a high-risk firm in a declining industry, it would have to pay a 20 percent interest rate on its bonds, and the “increase in the value of the firm would be much less.” Mr. Rayon says that a 20 percent interest rate “would mean that the value of the firm would increase more than Mr. Wool expects because of a larger tax shield.” Mr. Orlon, chairman of the board of NETC, says that Wool, Nylon, and Rayon are all wrong and that the total value of the firm would remain at $10 million “because bond investors are risk-averse too!”

Discuss the arguments given by Wool, Rayon, Nylon, and Orlon.

f. Suppose that, because of the new debt, there are new costs associated with possible financial distress. These costs can be expressed as 2 percent of the new firm value.

Does this new information change the analysis?

g. Mr. Buck, loan officer at the First Cotton Mather National Bank (FCMNB), received an application for a 20-year $2 million loan from NETC. FCMNB is one of the few banks in the United States that make long-term loans. Although NETC is a wellknown and respected local firm, Mr. Buck is worried about whether he should approve the loan. Does he have any reason to examine this loan application more carefully than (for example) one from Cotton Mather Electric Utility Company? What (if any) are the risks of making the loan to NETC?

Step by Step Answer:

Corporate Finance

ISBN: 9780071229036

6th International Edition

Authors: Stephen Ross, Randolph Westerfield, Jeffrey Jaffe