17.14 Schwartz & Brothers Inc. is in the process of deciding whether to make an equity investment...

Question:

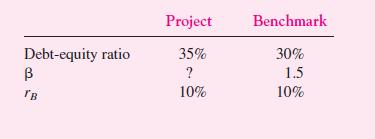

17.14 Schwartz & Brothers Inc. is in the process of deciding whether to make an equity investment in a project of holiday gifts production and sales. Arron Buffet is in charge of the feasibility study of the project. To better assess the risk of the project, he used the average of 10 other firms in the holiday gift industry with similar operational scales as the benchmark. The figures that he has are as follows:

The expected market return is 17 percent, and the risk-free interest rate is 9 percent.

Corporate tax rate is 40 percent. The initial investment in the project is estimated at $325,000, and the cash flow at the end of the first year is $55,000. Annual cash flow will grow at a constant rate of 5 percent till the end of the fifth year and remain constant forever thereafter. Should Schwartz & Brothers invest in this project (assume that the bond beta is zero)?

Step by Step Answer:

Corporate Finance

ISBN: 9780071229036

6th International Edition

Authors: Stephen Ross, Randolph Westerfield, Jeffrey Jaffe