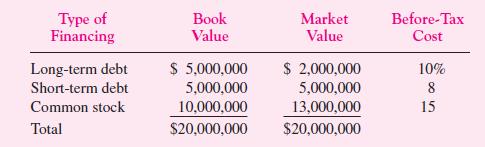

17.7 Value Company has compiled the following information on its financing costs: Value is in the 34-percent

Question:

17.7 Value Company has compiled the following information on its financing costs:

Value is in the 34-percent tax bracket and has a target debt-equity ratio of 100 percent. Value’s managers would like to keep the market values of short-term and long-term debt equal.

a. Calculate the weighted average cost of capital for Value Company using i. Book-value weights ii. Market-value weights iii. Target weights

b. Explain the differences between the WACCs. What are the correct weights to use in the WACC calculation?

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Corporate Finance

ISBN: 9780071229036

6th International Edition

Authors: Stephen Ross, Randolph Westerfield, Jeffrey Jaffe

Question Posted: