Although Mexico had allowed its peso to fluctuate within a narrow band, the government had virtually pegged

Question:

Although Mexico had allowed its peso to fluctuate within a narrow band, the government had virtually pegged the peso to the US dollar since 1990. However, on December 20, 1994, Mexico unexpectedly announced its decision to float the peso and a 40 percent devaluation followed in the next 2 days. The peso devaluation and the peso float, at first glance, seemed to have caused serious problems for General Motors (GM), whose manufacturing facilities in Mexico depend heavily on materials and components from the USA. An emergency meeting of the GM Executive Committee was called on December 24 in Detroit, to deal with the consequences of the devaluation and the float. Gary Henson, President and Managing Director

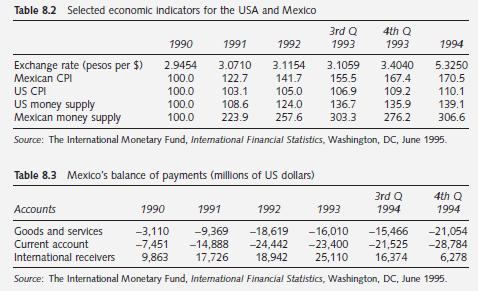

of GM de Mexico since December 1992, knew that all of the company’s top executives would be attending the meeting and felt certain that he would be asked why the devaluation and the float had caught him off guard. He decided to analyze economic statistics for both Mexico and the USA (see tables 8.2 and 8.3) along with the news clippings in his file on the Mexican peso.

Concern over the possibility of devaluation had existed for years, from 1990 to December 20, 1994, because real exchange rates for the peso had skyrocketed. However, many observers felt that President Salinas’s economic reforms had improved Mexico’s economy to such an extent that devaluation would not be necessary.

Henson was, therefore, not the only person caught off guard by the size of the devaluation and by the timing of the float. When the Mexican Central Bank opened on December 22, it began quoting pesos at 5.5 per US dollar, then as low as 6.33; the peso dropped to 5.8 by the end of the day. By December 23, foreign-exchange experts had become sharply divided on how far the peso might fall. Some said that the foreign-exchange market had already overreacted, but others saw no end in sight to the peso’s depreciation. Analysts also disagreed on whether the valuation and the float would be sufficient to correct the country’s balance-ofpayments difficulties and other economic problems. All these conflicting and perplexing points of view made it more difficult for Henson to assess the effects of the float and the devaluation on GM’s operations in Mexico.

Although there are some historical exceptions, exchange rate stabilization programs commonly result in a specific dynamic of consumption and investment patterns, current-account deficits, and exchange rate pressures. The typical pattern of exchange rate stabilization programs includes the following (Gruben 1996). First, despite reductions in inflation, the real exchange rate rises because some inflation remains and is not offset by nominal exchange rate movements. Second, the trade and current-account balances deteriorate. Third, in the early stages of the program, capital inflows finance the excess of consumption and investment over domestic production, allowing a boom to ensure, but the inflows ultimately reverse. Fourth, with this reversal, the growing current-account deficit can no longer be financed, the consumption boom ends, and the exchange rate stabilization program collapses.

Case Questions 1 Do you think that the peso had fallen far enough as of December 22 or that it would continue to lose value? (Hint: answer this question using equation 8.3.) Is the predicted exchange rate usually accurate?

2 Could the peso float have been forecasted? (Hint: answer this question using economic indicators such as the balance of payments, international reserves, inflation, and money supply.)

3 What alternatives were available to the Mexican government for dealing with its balanceof-

payments problems?

4 Assume that Mexico imposed prolonged foreign-exchange controls and thus GM de Mexico, the Mexican subsidiary of General Motors, could not import crucial materials and components from the USA. Briefly outline courses of action that GM de Mexico should take to cope with the foreign-exchange controls.

5 Is there any evidence that the typical pattern of exchange rate stabilization programs suggested by researchers such as William Gruben took place in Mexico?

6 The website of the Chicago Mercantile Exchange, www.cme.com, provides information on currency futures prices, including recent quotes and trends. Because a futures contract is similar to a forward contract, it can be used to forecast the value of a currency. Use this website to review the recent trend of futures prices for the Mexican peso and to answer the following question: Why do you think that the futures prices of the peso have changed over the past few months? Discuss how this information could be of assistance to Mr Gary Henson, President and Managing Director of GM de Mexico. The website of Olsen and Associates, www.olsen.ch, provides information on technical forecasts. Visit this website to obtain technical information for several currencies.

Step by Step Answer:

Global Corporate Finance Text And Cases

ISBN: 9781405119900

6th Edition

Authors: Suk H. Kim, Seung H. Kim