An American firm purchases ($4,000) worth of perfume (Mex($20,000)) from a Mexican firm. The American distributor must

Question:

An American firm purchases \($4,000\) worth of perfume (Mex\($20,000)\) from a Mexican firm. The American distributor must make the payment in 90 days, in Mexican pesos.

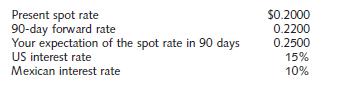

The following quotations and expectations exist for the Mexican peso:

(a) What is the premium or discount on the forward Mexican peso? What is the interest differential between the USA and Mexico? Is there an incentive for coveredinterest arbitrage?

(b) If there is an incentive for covered-interest arbitrage, how can an arbitrageur take advantage of the situation? Assume: (1) the arbitrageur is willing to borrow \($4,000\) or Mex\($20,000;\) and (2) there are no transaction costs.

(c) If transaction costs are \($100,\) would an opportunity still exist for covered-interest arbitrage?

(d) What alternatives are open to the importer if she wants to cover her transaction against the foreign-exchange risk?

(e) Assume that your expectation proves correct and that the importer decides to cover this transaction. What would be the opportunity cost of each alternative? Which alternative is more attractive and why?

(f) Would you advise the American firm to cover its foreign transaction? Why or why not?

Step by Step Answer:

Global Corporate Finance Text And Cases

ISBN: 9781405119900

6th Edition

Authors: Suk H. Kim, Seung H. Kim