Capital budgeting tools Scottys Pickle Factory is considering purchase of a new machine to supplement his operations.

Question:

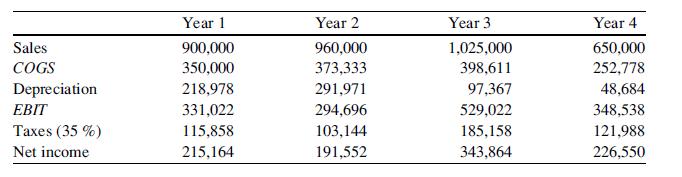

Capital budgeting tools Scotty’s Pickle Factory is considering purchase of a new machine to supplement his operations. After a long, drawn-out process, his financial team has come up with estimates regarding the project. First, they think the initial addition to net capital spending will be $657,000. In addition, they believe they will have to change their level of net working capital from

$109,000 to $176,500. They have created the following pro forma statements for each year. Scotty’s required WACC is 6.74 %.

(a) What is the project’s payback period?

(b) What is the project’s discounted payback period?

(c) What is the project’s net present value?

(d) What is the project’s profitability index?

(e) What is the projects internal rate of return?

Step by Step Answer:

Applied Corporate Finance Questions Problems And Making Decisions In The Real World

ISBN: 9781493952991

1st Edition

Authors: Mark K. Pyles