Given the following returns on Stock J and the market during the last three years, what is

Question:

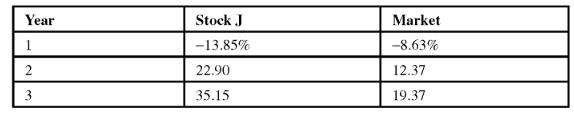

Given the following returns on Stock J and "the market" during the last three years, what is the beta coefficient of Stock J?

a. 0.80

b. 1.25

c. 1.50

d. 1.75

Transcribed Image Text:

Year Stock J Market 1 -13.85% -8.63% 2 22.90 12.37 3 35.15 19.37

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 100% (QA)

Answered By

Gauri Hendre

I worked as EI educator for Eduphy India YT channel. I gave online tutorials to the students who were living in the villages and wanted to study much more and were preparing for NEET, TET. I gave tutions for topics in Biotechnology. I am currently working as a tutor on course hero for the biochemistry, microbiology, biology, cell biology, genetics subjects. I worked as a project intern in BAIF where did analysis on diseases mainly genetic disorders in the bovine. I worked as a trainee in serum institute of India and Vasantdada sugar institute. I am working as a writer on Quora partner program from 2019. I writing on the topics on social health issues including current COVID-19 pandemic, different concepts in science discipline. I learned foreign languages such as german and french upto A1 level. I attended different conferences in the science discipline and did trainings in cognitive skills and personality development skills from Lila Poonawalla foundation. I have been the member of Lila poonawalla foundation since 2017. Even I acquired the skills like Excel spreadsheet, MS Office, MS Powerpoint and Data entry.

5.00+

4+ Reviews

10+ Question Solved

Related Book For

Question Posted:

Students also viewed these Business questions

-

Given the following returns on Stock J and the "market" during the last three years, what is the beta coefficient of Stock J? Year Stock J Market 1. -13.85% -8.63% 2. 22.90% 12.37% 3. 35.15% 19.37%...

-

Consider the following information: Rate of Return if State Occurs State of Economy Boom :57 Bust of Economy .66 .34 Probability of State Stock A .09 .13 Stock B Stock C .03 .19 .24 -.04 a. What is...

-

You are given the following returns on "the market" and Stock F during the last three years. We could calculate beta using data for Years1and2and then, after Year3,calculate a new beta for...

-

Consider the approximation of the welfare loss due to inter-area deviations from the correct rate of care. All else equal, which procedures would yield the largest welfare losses those with low price...

-

xt + 1 = 1.5xt(1 - xt) at the equilibrium x* = 0. Draw the tangent line approximating the given system at the specified equilibrium and compare the cobweb diagrams. Use the stability theorem to check...

-

Use a computer package to find the probability density function and cumulative distribution function at x = 0.5, and the upper quartile, of beta distributions with the following parameter values: (a)...

-

How do we interpret a silhouette value?

-

Grider Industries, Inc. issued $6,000,000 of 8% debentures on November 1, 2010. The bonds pay interest semiannually on May 1 and November 1. The maturity date on these bonds is November 1, 2020. The...

-

? _ _ _ _ _ _ _ d e s c r i b e s t h e f i r s t s t e p i n t h e a c c o u n t i n g p r o c e s s ? # 1 g e n e r a t i n g f i n a n c i a l s t a t e m e n t s r e c o r d i n g t r a n s a c t...

-

It has been estimated that the new product just presented by your Research and Development (R&D) department will bring in net cash flows of $80,000 per year for four years. Marketing will begin...

-

Which of the following statements is incorrect! a. The slope of the security market line is measured by beta. b. Two securities with the same stand-alone risk can have different betas. c....

-

Write an SQL statement to display the SKU, SKU_Description, and WarehouseID for products having QuantityOnHand equal to 0. Sort the results in ascending order by WarehouseID.

-

The requirement for extended disclosures for oil and gas reserves described in Chapter 2 followed a Congressional hearing on the poor disclosures that Shell Oil had for its reserves. A.Explain three...

-

Question 9 Big Data techniques implemented in the financial sector include: fraud detection O marketing email campaign O customer relationship management techniques O inventory analysis

-

Problem 8-19A Attaining notfonpmt entity variances The Redmond Management Association held its annual public relations luncheon in April Year 2. Based on the previous year's results, the organization...

-

Kay, who is not a real estate dealer, sold an apartment house to Polly during the current year (2020). The closing statement for the sale is as follows. Total selling price $190,000 Add: Polly's...

-

1 English Writing Requirement Assignment Guidelines Sem 1 2023-24 Subject code AAE1D02 Subject title Introduction to Space Exploration Credit value 3 CAR Teachers Prof. WEN Chih-Yung, Prof. WU Bo,...

-

You are considering adding a new software title to those published by your highly successful software company. If you add the new product, it will use capacity on your disk duplicating machines that...

-

An educational researcher devised a wooden toy assembly project to test learning in 6-year-olds. The time in seconds to assemble the project was noted, and the toy was disassembled out of the childs...

-

Yard Professionals Incorporated experienced the following events in Year 1, its first year of operation: Performed services for $31,000 cash. Purchased $7,800 of supplies on account. A physical count...

-

This question is from case # 24 of book Gapenski's Cases in Healthcare Finance, Sixth Edition Select five financial and five operating Key Performance Indicators (KPIs) to be presented at future...

-

assume that we have only two following risk assets (stock 1&2) in the market. stock 1 - E(r) = 20%, std 20% stock 2- E(r) = 10%, std 20% the correlation coefficient between stock 1 and 2 is 0. and...

Study smarter with the SolutionInn App