In December 2002, Lockheed Martin, with its F-16 Fighting Falcon, beat French and Anglo- Swedish rivals to

Question:

In December 2002, Lockheed Martin, with its F-16 Fighting Falcon, beat French and Anglo-

Swedish rivals to land a \($3.6\) billion deal from Poland, which is Eastern Europe’s largest defense order. Do you know how Lockheed won the contract? The answer is simple. Lockheed’s offset offer was larger than that of their two rivals. Lockheed put together over 100 projects it valued at \($9.8\) billion, compared with \($7.8\) billion from its Anglo-Swedish rival and \($3.9\) billion from its French rival.

In recent years, The General Accounting Office (GAO) of the USA examined offset agreements between the US arms producers and 10 buyer countries in the Middle East, Asia, and Europe (which included the world’s most active buyers of US arms, such as Taiwan, South Korea, Saudi Arabia, Kuwait, and the UK). The USA controls about one-half of the world’s arms exports and dominates sales in most regions. The GAO study also found that the United Arab Emirates (UAE) have broken new ground in recent years by demanding that Boeing invest in and help with big projects that are not related to the company’s main lines of business.

For example, the UAE requires that Boeing and other sellers return 60 percent of the value of its arms purchases through investment in commercially viable ventures. And the seller company is deemed to have satisfied its obligation only on the basis of the profits generated by these ventures. The UAE and other countries increasingly insist that the contracts and technologies be delivered into new businesses, rather than existing ones.

“Offsets” are trade demanded by a foreign buyer, which for decades mostly wanted to help the US seller build the planes, missiles, or other weapons being sold. Since the mid-

1980s, buyers have increasingly wanted commercial and military technology to broaden the purchaser’s economy. In fact, such contracts and technology transfers now occur in aero

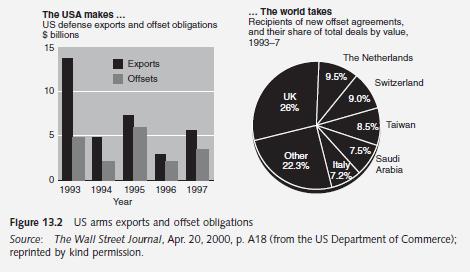

space, transportation equipment, and electrical equipment. This form of countertrade is an arrangement similar to counterpurchase, but the seller is required to produce parts, source parts, or assemble the product in the importing country. Many countries demand ever-higher percentages, often 100 percent or more, of the value of the contract to be returned to the purchasing nation through offsets. For example, Boeing sold AWACS to the UK Ministry of Defence and agreed to buy 130 percent of the value of the transaction in British goods. In April 2000, the US Department of Commerce reported that offset transactions had increased from 35 percent of the value of the contracts in 1993 to 42 percent in 1994. Figure 13.2 shows that offset obligations have accounted for approximately 70 percent of the contract value from 1995 to 1997.

One recent GAO report cited an instance in which, in return for its sale of AH-64 Apache helicopters to the UAE, Boeing helped the country to form companies that make products for cleaning up oil spills or for recycling used photocopier and laser printer cartridges. The US government has expressed concern about this and other offset transactions. A spokesman for Boeing, however, said that the big plane-maker has no choice but to offer offsets if the company wants to win foreign sales. “The only other alternative is to let the sale and all of the related jobs go to another manufacturer that is willing to provide offsets,” he added.

Other US defense companies say that without the offset agreement, they would lose the sales to providers in Europe, Russia, or elsewhere. They also say that the deals lower the cost to US taxpayers of acquiring weapons for the Pentagon, because these deals lessen US companies’

dependence on Pentagon contracts.

In recent years, entrepreneurs in the Middle East and Asia have launched more exotic plans, called offset investment funds. They have pooled money from weapons sellers to be invested for offset credit. Lockheed Martin Corp.’s \($6.4\) billion sale of F-16 jets to the UAE in March 2000 corroborates this inference. Lockheed satisfied its offset by investing \($160\) million in the petroleum-related “investment portfolio” of the Offsets Group, which administers the program in the UAE. Some US government officials have expressed a concern about the possibility that such offset payments could be used to channel favors to foreign officials.

That is barred under US law.

Case Questions 1 The terms of the offset on individual contracts may vary substantially. The most common categories of offsets are coproduction, licensed production, subcontractor production, overseas investment, and technology transfer. Briefly describe each of these offsets.

2 What are the policy goals of those foreign countries that demand offset concessions to US arms producers?

3 What is the adverse economic impact of offset agreements in the USA?

4 Name and discuss the US law that makes it illegal for US companies to make payments to foreign officials with hopes of winning their favors in business transactions? (Hint: look at chapter 20: Multinational Accounting.)

5 Explain why Lockheed’s \($160\) million investment in the UAE Offset Group might violate the US law.

6 Use the website of the American Countertrade Association (ACA), www.countertrade.org, to list the types of services provided by the ACA.

Step by Step Answer:

Global Corporate Finance Text And Cases

ISBN: 9781405119900

6th Edition

Authors: Suk H. Kim, Seung H. Kim