Optimal capital structure. Bobbys Beer Barn just paid a dividend of $1.06 and has seen their stock

Question:

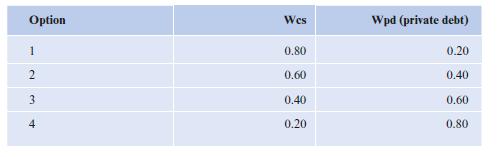

Optimal capital structure. Bobby’s Beer Barn just paid a dividend of $1.06 and has seen their stock price rise to $27.48. However, they are attempting to purchase a new plant that needs capital of $1.5 million. This capital will come from common stock and bank debt. They have the following choices in terms of getting the capital:

If the firm uses option 1, the cost of debt is 5.87% and the cost of equity is 6.10%. The cost of equity is estimated based upon the capital asset pricing model assuming a market risk premium of 7.5% and a risk-free rate of 1.5%. However, for every 20% increase in debt (and resulting 20% decrease in equity), the cost of debt increases by 1%. Also, for every 20% increase in debt, the firm’s beta increases by 0.4. This would then affect the cost of equity. Given a tax rate of 21%, what is the optimal (of these four) capital structure?

Step by Step Answer:

Applied Corporate Finance Making Value Enhancing Decisions In The Real World

ISBN: 9783030816308

2nd Edition

Authors: Mark K. Pyles