Optimal capital structure You are in charge of the finance department at Johnnys Kawasaki, Inc. The firm

Question:

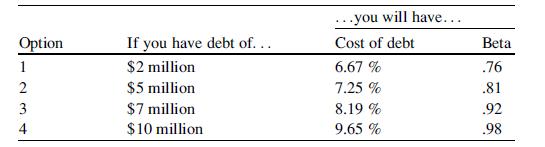

Optimal capital structure You are in charge of the finance department at Johnny’s Kawasaki, Inc. The firm is considering expanding to Europe and will build a plant in London. The plant will cost approximately $14 million. Your duty is to identify the optimal capital structure with which to pay for the $14 million dollar project. After months of work, you have identified the following data.

In addition, the expected return on the market is 9 % and the risk-free rate is 3 %.

(a) Of these options, which capital structure is best?

(b) Given the optimal capital structure, how much will obtaining this $14M in funding cost the firm?

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Applied Corporate Finance Questions Problems And Making Decisions In The Real World

ISBN: 9781493952991

1st Edition

Authors: Mark K. Pyles

Question Posted: