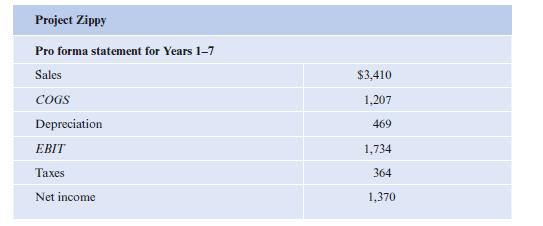

Project expected cash flows Suppose you are considering a seven-year project with the following annual pro forma

Question:

Project expected cash flows Suppose you are considering a seven-year project with the following annual pro forma statement:

In addition, the project is going to require net capital spending of 10,000 and an increase in NWC of $2,400:

(a) What is the project NINV?

(b) What is the project operating cash flow?

(c) What is the expected total cash flow for each of the seven years?

(d) How would your answer to b and c above change if the sales were projected to increase by 5% in each successive year following the first?

(e) Suppose the project has a salvage value of $2,000 at the end of the project.

How does this change the expected total cash flow?

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Applied Corporate Finance Making Value Enhancing Decisions In The Real World

ISBN: 9783030816308

2nd Edition

Authors: Mark K. Pyles

Question Posted: