Project expected cash flows You are in charge of evaluating a project that is designed to produce

Question:

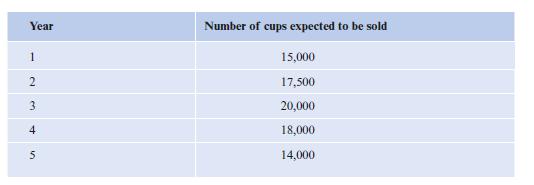

Project expected cash flows You are in charge of evaluating a project that is designed to produce coffee cups. The project requires the purchase of a new machine that costs $75,000 and will require an increase in NWC of $15,000 at initiation. The machine can be depreciated as a three-year property class, but the increase in NWC cannot be depreciated. It is expected that you can sell the following number of coffee cups:

Each cup will sell for $5 throughout the five-year project. Cost of goods sold will be 30% throughout, while the tax rate is 21%. At the end of the project, you can recover the entire increase in NWC and will sell the machine for $15,000.

What are the expected cash flows for the five years of the project?

Step by Step Answer:

Applied Corporate Finance Making Value Enhancing Decisions In The Real World

ISBN: 9783030816308

2nd Edition

Authors: Mark K. Pyles