Project F has a cost of $3,000 and project G has a cost of $4,000. These two

Question:

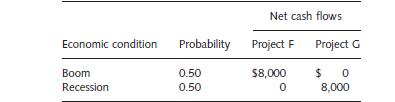

Project F has a cost of $3,000 and project G has a cost of $4,000. These two projects are mutually independent and their possible net cash flows are given below. Assume that the cost of capital is 10 percent.

(a) Determine the net present value of projects F and G.

(b) Determine the standard deviation of projects F and G.

(c) Determine the portfolio net present value and the portfolio standard deviation.

(d) Discuss the significance of the portfolio effect in terms of international context.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Global Corporate Finance Text And Cases

ISBN: 9781405119900

6th Edition

Authors: Suk H. Kim, Seung H. Kim

Question Posted: