Suppose you purchase a 30-year, zero-coupon bond with a yield to maturity of 6%. You hold the

Question:

Suppose you purchase a 30-year, zero-coupon bond with a yield to maturity of 6%.

You hold the bond for five years before selling it.

a. If the bond’s yield to maturity is 6% when you sell it, what is the annualized rate of return of your investment?

b. If the bond’s yield to maturity is 7% when you sell it, what is the annualized rate of return of your investment?

c. If the bond’s yield to maturity is 5% when you sell it, what is the annualized rate of return of your investment?

d. Even if a bond has no chance of default, is your investment risk free if you plan to sell it before it matures? Explain.

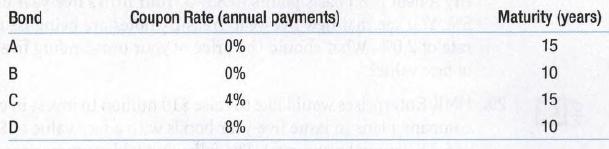

Consider the following bonds.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: