The following selected amounts are from the separate financial statements of a US parent company and its

Question:

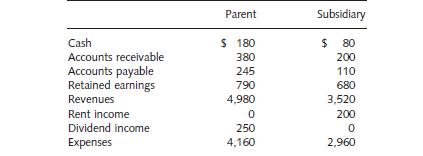

The following selected amounts are from the separate financial statements of a US parent company and its foreign subsidiary:

Additional assumptions are as follows: (1) the parent owes the subsidiary \($70;\) (2) the parent owns 100 percent of the subsidiary; (3) during the year, the subsidiary paid the parent a dividend of \($250;\) (4) the subsidiary owns the building that the parent rents for \($200;\) and (5) during the year, the parent sold some inventory to the subsidiary for \($2,200,\) whose cost was \($1,500\) to the parent, and in turn, the subsidiary sold the inventory to an unrelated party for \($3,200.

(a)\) What is the parent’s unconsolidated net income?

(b) What is the subsidiary’s net income?

(c) What is the consolidated profit on the inventory that the parent originally sold to the subsidiary?

(d) What are the amounts of the following items, on a consolidated basis?

• cash • accounts receivables • accounts payable • revenues • expenses • dividend income • rent income • retained earnings.

Step by Step Answer:

Global Corporate Finance Text And Cases

ISBN: 9781405119900

6th Edition

Authors: Suk H. Kim, Seung H. Kim