The most likely tax environment in which Wilson Papers shareholders would prefer that Wilson repurchase its shares

Question:

The most likely tax environment in which Wilson Paper’s shareholders would prefer that Wilson repurchase its shares (share buybacks) instead of paying dividends is one in which:

A. the tax rate on capital gains and dividends is the same.

B. capital gains tax rates are higher than dividend income tax rates.

C. capital gains tax rates are lower than dividend income tax rates.

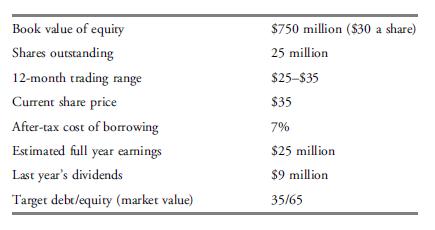

Janet Wu is treasurer of Wilson Paper Company, a manufacturer of paper products for the office and school markets. Wilson Paper is selling one of its divisions for \($70\) million cash. Wu is considering whether to recommend a special dividend of \($70\) million or a repurchase of 2 million shares of Wilson common stock in the open market. She is reviewing some possible effects of the buyback with the company’s financial analyst. Wilson has a long-term record of gradually increasing earnings and dividends. Wilson’s board has also approved capital spending of \($15\) million to be entirely funded out of this year’s earnings.

Step by Step Answer:

Corporate Finance A Practical Approach

ISBN: 9781118217290

2nd Edition

Authors: Michelle R Clayman, Martin S Fridson, George H Troughton, Matthew Scanlan