A friend of yours, Jack Andrews, is quite excited over the opportunity he has to purchase the

Question:

A friend of yours, Jack Andrews, is quite excited over the opportunity he has to purchase the land and several miscellaneous assets of Drake Bowling Lanes Company for \(\$ 400,000\). Andrews tells you that Mr. and Mrs. Drake (the sole stockholders in the company) are moving due to Mr. Drake's ill health. The annual rent on the building and equipment is \(\$ 54,000\).

Drake reports that the business earned a profit of \(\$ 100,000\) in 1999 (last year). Andrews believes an annual profit of \(\$ 100,000\) on an investment of \(\$ 400,000\) is a really good deal. But, before completing the deal, he asks you to look it over. You agree and discover the following:

1. Drake has computed his annual profit for 1999 as the sum of his cash dividends plus the increase in the Cash account: Dividends of \(\$ 60,000+\) Increase in Cash account of \(\$ 40,000=\$ 100,000\) profit.

2. As buyer of the business, Andrews will take over responsibility for repayment of a \(\$ 300,000\) loan (plus interest) on the land. The land was acquired at a cost of \(\$ 624,000\) seven years ago.

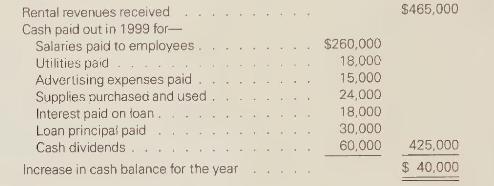

3. An analysis of the Cash account shows the following for 1999:

4. You also find that the annual rent of \(\$ 54,000\), a December utility bill of \(\$ 4,000\), and an advertising bill of \(\$ 6,000\) have not been paid.

a. Prepare a written report for Andrews giving your appraisal of Drake Bowling Lanes Company as an investment. Comment on Drake's method of computing the annual profit of the business.

b. Include in your report an approximate income statement for 1999 .

Step by Step Answer:

Financial Accounting A Business Perspective

ISBN: 9780072289985

7th Edition

Authors: Roger H. Hermanson, James Don Edwards