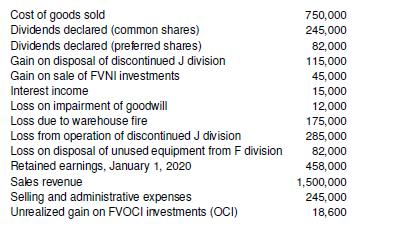

Below are adjusted accounts and balances for Ace Retailing Ltd. for the year ended December 31, 2020:

Question:

Below are adjusted accounts and balances for Ace Retailing Ltd. for the year ended December 31, 2020:

Additional information:

1. Ace decided to discontinue the J division operations. A formal plan to dispose of J division has been completed. There are no plans to dispose of F division at this time.

2. During 2020, 400,000 common shares were outstanding with no shares activity for 2020.

3. Ace’s tax rate is 27%.

4. Ace follows IFRS and accounts for its investments in accordance with IFRS 9 meaning that any unrealized gains/losses for FVNI are reported through net income and FVOCI are reported in OCI.

Required:

a. Prepare a multiple-step statement of income for the year ended December 31, 2020, in good form reporting expenses by function.

b. Prepare a combined statement of income and comprehensive income in good form reporting expenses by function.

c. How would the answer in part

(b) differ if a statement of comprehensive income were to be prepared without combining it with the statement of income?

d. Prepare a single-step statement of income in good form reporting expenses by function.

e. Explain what types of items are to be reported in other revenue and expenses as part of continuing operations, and provide examples for a retail business.

Step by Step Answer:

Intermediate Financial Accounting Volume 1

ISBN: 9781539980674

1st Edition

Authors: Glenn Arnold, Suzanne Kyle, Lyryx Learning