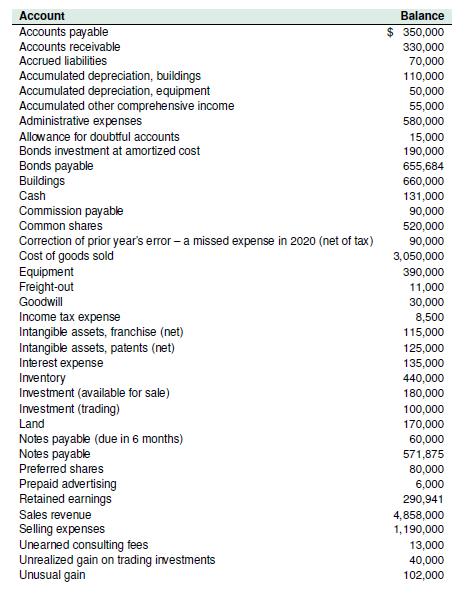

Below is the trial balance for Johnson Berthgate Corp. at December 31, 2021. Accounts are listed in

Question:

Below is the trial balance for Johnson Berthgate Corp. at December 31, 2021. Accounts are listed in alphabetical order and all have normal balances.

Additional information as at December 31, 2021:

1. Inventory has a net realizable value of $430,000. The weighted average cost method of inventory valuation was used.

2. Trading investments are securities held for trading purposes and have a fair value of $120,000. Investments in bonds are being held to maturity at amortized cost with interest payments each December 31. Investments in other securities are classified as available for sale (FVOCI) and any gains or losses will be recognized through other comprehensive income (OCI). These have a fair value of $180,000 at the reporting date.

3. Correction of the prior period error relates to a missed travel expense from 2020.

The books are still open for 2021.

4. Patents and franchise were being amortized on a straight-line basis. Accumulated amortization to December 31, 2021 is $80,000 for patents and $45,000 for the franchise.

5. Goodwill was recognized at the time of the purchase as the excess of the cash paid purchase price over the net identifiable assets.

6. The bonds were issued at face value on December 31, 2005 and are 5%, 20 year, with interest payable annually each December 31.

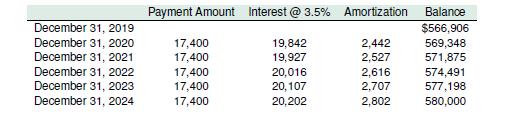

7. The 3%, 5-year note payable will be repaid by December 31, 2024 and was signed when market rates were 3.5%.

Below is the payment schedule:

8. During the year ended December 31, 2021, no dividends were declared and there was no preferred or common share activity.

9. On December 31, 2021, the share structure was; common shares, unlimited authorized, 260,000 shares issued and outstanding. $3 preferred shares, non-cumulative, 1,200 authorized, 800 shares issued and outstanding.

10. The company prepares financial statements in accordance with IFRS and investments in accordance with IFRS 9.

11. The income tax rate is 25%.

Required:

a. Prepare a classified statement of financial position as at December 31, 2021, in good form, including all required disclosures identified in Chapter 4. Adjust the account balances as required based on the additional information presented.

b. Calculate the company’s debt ratio and equity ratio and comment on the results.

c. Assume now that accounts receivable is made up of the following:

Accounts with debit balances $ 580,000 Accounts with credit balances (250,000)

Discuss whether this change in the accounts will affect the liquidity of this company.

Round final ratio answers to the nearest 2 decimal places.

Step by Step Answer:

Intermediate Financial Accounting Volume 1

ISBN: 9781539980674

1st Edition

Authors: Glenn Arnold, Suzanne Kyle, Lyryx Learning