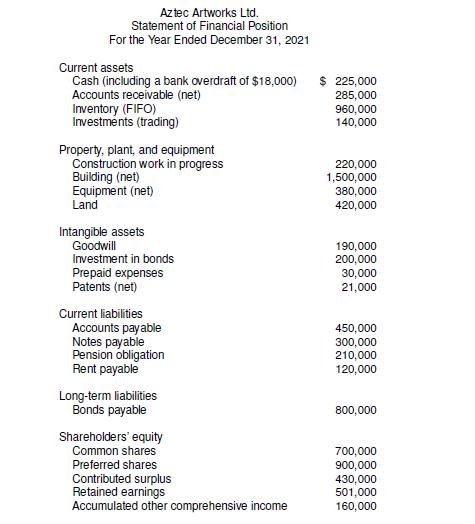

Below is a statement of financial position as at December 31, 2021, for Aztec Artworks Ltd., prepared

Question:

Below is a statement of financial position as at December 31, 2021, for Aztec Artworks Ltd., prepared by the company bookkeeper:

Additional information as at December 31, 2021:

1. Cash is made up of petty cash of $3,000, a bond sinking fund of $100,000, and a bank overdraft of $18,000 held at a different bank than the bank account where the cash balance is currently on deposit.

2. Accounts receivable balance of $285,000 includes:

Credit balances to be cleared in 90 days 35,000 Allowance for doubtful accounts 12,000 The company considers the credit balance to be significant.

3. Inventory ending balance does not include inventory costing $20,000 shipped out on consignment on December 30, 2021. The company uses FIFO cost formula and a perpetual inventory system.

The net realizable value of the inventory at year-end is:

Inventory, December 31 $960,000 Inventory on consignment 25,000 4. Investments are held for trading purposes. Their fair value at year-end is $135,000.

5. The accumulated depreciation account balance for buildings is $450,000 and $120,000 for equipment. The construction work-in-progress represents the costs to date on a new building in the process of construction. The land where the building is being constructed was purchased of $220,000. The remaining land is being held for investment purposes.

6. Goodwill of $190,000 was included in the accounts when management decided that their product development team has added significant value to the company.

7. The investment in bonds is being held to maturity in 2030, and is accounted for using amortized cost.

8. Patents were purchased by Aztec on January 1, 2019, at a cost of $30,000. They are being amortized on a straight-line basis over 10 years.

9. Income tax payable of $80,000 was accrued on December 31 and included in the accounts payable balance.

10. The notes payable are due June 30, 2022. The principal is not due until then.

11. The pension obligation is considered by the auditors to be a long-term liability.

12. The 20-year bonds payable bear interest at 5% and are due August 31, 2025. The bonds’ annual interest was paid on December 31. The company established the bond sinking fund that is included in the cash balance.

13. For common shares, 900,000 are authorized and 700,000 are issued and outstanding.

The preferred shares are $2, non-cumulative, participating shares. Fifty thousand are authorized and 20,000 are issued and outstanding.

14. Net sales for the year are $3,000,000 and gross profit is 40%.

Required:

a. Prepare a corrected classified SFP/BS as at December 31, 2021, in good form, including all required disclosures identified in Chapter 4. Adjust the account balances as required based on the additional information presented.

b. Calculate one liquidity ratio and one activity ratio and comment on the results. Use ending balances in lieu of averages when calculating ratios.

Step by Step Answer:

Intermediate Financial Accounting Volume 1

ISBN: 9781539980674

1st Edition

Authors: Glenn Arnold, Suzanne Kyle, Lyryx Learning