Clean-Sweep Janitorial, Inc., a company providing janitorial services, was organized July 1, 1999. The following account numbers

Question:

Clean-Sweep Janitorial, Inc., a company providing janitorial services, was organized July 1, 1999. The following account numbers and titles constitute the chart of accounts for the company:

Transactions Economy Laundry Company had the following transactions in August 1999:

Aug. 1 Issued capital stock for cash, \(\$ 150,000\).

3 Borrowed \(\$ 40,000\) from the bank on a note.

4 Purchased cleaning equipment for \(\$ 25,000\) cash.

6 Performed services for customers who promised to pay later, \(\$ 16,000\).

Paid this month's rent on a building, \(\$ 2,800\).

10 Collections were made for the services performed on August 6, \$3,200 14 Supplies were purchased on account for use this month, \(\$ 3,000\).

17 A bill for \(\$ 400\) was received for utilities for this month.

25 Laundry services were performed for customers who paid immediately, \(\$ 22,000\).

31 Paid employee salaries, \(\$ 6,000\).

31 Paid cash dividend, \(\$ 2,000\).

Required

a. Prepare journal entries for these transactions.

b. Post the journal entries to T-accounts. Enter the account number in the Posting Reference column of the journal as you post each amount. Use the following account numbers:

\begin{tabular}{ll}

Acct. & \\

No. & \multicolumn{1}{c}{ Account Title } \\

100 & Cash \\

103 & Accounts Receivable \\

170 & Equipment \\

200 & Accounts Payable \\

201 & Notes Payable \\

300 & Capital Stock \\

320 & Dividends \\

400 & Service Revenue \\

507 & Salaries Expense \\

511 & Utilities Expense \\

515 & Rent Expense \\

518 & Supplies Expense \end{tabular}

c. Prepare a trial balance as of August 31, 1999.

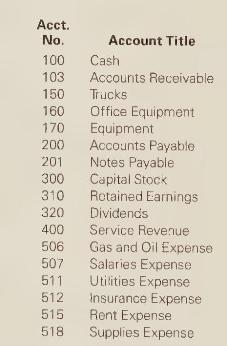

Clean-Sweep Janitorial, Inc., a company providing janitorial services, was organized July 1, 1999. The following account numbers and titles constitute the chart of accounts for the company:

\begin{tabular}{ll}

Acct. & \\

No. & \multicolumn{1}{c}{ Account Title } \\

100 & Cash \\

103 & Accounts Receivable \\

150 & Trucks \\

160 & Office Equipment \\

170 & Equipment \\

200 & Accounts Payable \\

201 & Notes Payable \\

300 & Capital Stock \\

310 & Retained Earnings \\

320 & Dividends \\

400 & Service Revenue \\

506 & Gas and Oil Expense \\

507 & Salaries Expense \\

511 & Utilities Expense \\

512 & Insurance Expense \\

515 & Rent Expense \\

518 & Supplies Expense \end{tabular}

July 1 The company issued \(\$ 600,000\) of capital stock for cash.

5 Office space was rented for July, and \(\$ 5,000\) was paid for the rental.

8 Desks and chairs were purchased for the office on account, \(\$ 28,800\).

10 Equipment was purchased for \(\$ 50,000\); a note was given, to be paid in 30 days 15 Purchased trucks for \(\$ 150,000\), paying \(\$ 120,000\) cash and giving a 60 -day note to the dealer for \(\$ 30,000\).

July 18 Paid for supplies received and already used, \(\$ 2,880\).

23 Received \(\$ 17,280\) cash as service revenue.

27 Insurance expense for July was paid, \(\$ 4,500\)

30 Paid for gasoline and oil used by the truck in July, \(\$ 576\).

31 Billed customers for janitorial services rendered, \(\$ 40,320\).

31 Paid salaries for July, \(\$ 51,840\).

31 Paid utilities bills for July, \(\$ 5,280\).

31 Paid cash dividends, \(\$ 9,600\).

a. Prepare general ledger accounts for all of these accounts except Retained Earnings. The Retained Earnings account has a beginning balance of zero and maintains this balance throughout the period.

b. Journalize the transactions given for July 1999 in the general journal.

c. Post the journal entries to three-column ledger accounts.

d. Prepare a trial balance as of July 31, 1999 .

Step by Step Answer:

Financial Accounting A Business Perspective

ISBN: 9780072289985

7th Edition

Authors: Roger H. Hermanson, James Don Edwards