In the All About You feature, you learned that there are on-line investment services that provide advice

Question:

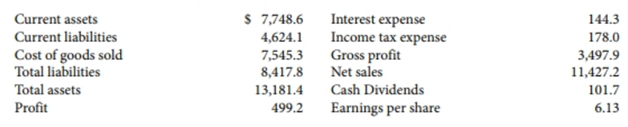

You obtain a copy of Canadian Tire€™s 2012 annual report and see the following information (in $ millions, except per share amounts) in the financial statements.

Instructions

(a) Calculate the following ratios for the 2012 fiscal year. Compare these to the 2011 ratios shown in the Ratio Analysis section of the chapter for Canadian Tire and reproduced in parentheses after each ratio below. For each ratio, has it improved or deteriorated from 2011?

1. Current ratio (1.7:1)

2. Inventory turnover (6.2 times)

3. Debt to total assets (64.3%)

4. Interest coverage (5.1 times)

5. Gross profit margin (29.5%)

6. Profit margin (4.5%)

7. Return on assets (4.0%)

8. Return on equity (11.1%)

9. Price-earnings ratio (12.7 times)

10. Payout ratio (19.6%)

(b) Based on your brief analysis of Canadian Tire€™s ratios, do you think buying Canadian Tire€™s shares is a good investment for you? Explain.

(c) If you are investing in the stock market, will you rely solely on your analysis of the financial statements? The history of Canadian Tire€™s stock price? Or do you think you might rely on both your financial statement analysis and the history of the stock price? Explain.

(d) In the €œAll About You€ feature, we learned that critics of message boards on investment services€™ sites say that message boards can intensify the rumour mill. Do you think that you should ignore message boards when making investment decisions? Explain.

Financial StatementsFinancial statements are the standardized formats to present the financial information related to a business or an organization for its users. Financial statements contain the historical information as well as current period’s financial...

Step by Step Answer:

Principles Of Financial Accounting

ISBN: 9781118757147

1st Canadian Edition

Authors: Jerry J. Weygandt, Michael J. Atkins, Donald E. Kieso, Paul D. Kimmel, Valerie Ann Kinnear, Barbara Trenholm, Joan E. Barlow