) million for the purchase of merchant portfolios in fiscal years 1994, 1995 and 1996, respectively. The...

Question:

\) million for the purchase of merchant portfolios in fiscal years 1994, 1995 and 1996, respectively. The Company purchased five merchant portfolios in fiscal 1994, nine merchant portfolios in fiscal year 1995 and five in fiscal year 1996

\section*{Financing Activities}

The significant increase in cash provided by financing activities for fiscal year 1995 resulted from the consummation of the Company's initial public offering in August 1994. Cash provided by financing activities for fiscal year 1995 was \(\$ 20.7\) million which reflects the net proceeds of the initial public offering after retirement of the Company's outstanding indebtedness to First Union National Bank of Tennessee and to ABC for the March 1994 ABC purchase. Additionally, the Company issued \(\$ 15.3\) million of long-term debt in connection with three of the nine merchant portfolios purchased in fiscal year 1995 .

The cash provided by financing activities for fiscal 1996 reflects the Company's consummation of its second and third public offerings in October 1995 and April 1996, respectively. Net cash provided by financing activities was \(\$ 124.8\) million in fiscal 1996 which reflects the net proceeds from the offerings after retirement of the Company's outstanding bank indebtedness.

\section*{Future Capital Needs}

Management believes that significant expenditures for the purchase of additional merchant portfolios may be required for the Company to sustain its growth in the future. Management expects to fund such purchases primarily through cash generated from operations and additional bank borrowings. Management believes the combination of these sources will be sufficient to meet the Company's anticipated liquidity needs and its growth plans through fiscal year 1997. The Company, however, may pursue additional expansion opportunities, including purchases of additional merchant portfolios, which may require additional capital, and the Company may incur, from time to time, additional short-term and long-term indebtedness or issue, in public or private transactions, equity or debt securities, the availability and terms of which will depend upon then prevailing market and other conditions.

The Company's revolving credit facility was amended and restated during fiscal year 1995 to increase the line of credit to \(\$ 17.5\) million. The Company repaid all outstanding debt related to this credit facility with the proceeds from its second public offering during fiscal year 1996. The amended agreement expires November 1,1996 with all amounts then outstanding under the agreement due on November 1, 1996, unless the agreement is extended or the outstanding amounts have been converted to a term loan requiring equal monthly payments for 48 months.

Borrowings under the amended revolving credit facility are used to finance purchases of merchant portfolios and equipment and for working capital purposes. Borrowings are secured by substantially all the Company's assets and life insurance policies on the lives of two of the Company's executive officers.

a. Which method is the company using to determine net cash provided by operating activities?

b. Why does the company show the indirect method below the statement of cash flows?

c. What is the trend of net cash provided by operating activities over the three years?

d. How has the company increased its account portfolios?

e. What items of property and equipment were acquired during the three-year period?

f. What was the major source of the huge increase in cash and cash equivalents over the three-year period? How were the proceeds used?

g. How does the company expect to finance future expenditures to acquire additional merchant portfolios?

h. How are amounts secured that are borrowed under the line of credit?

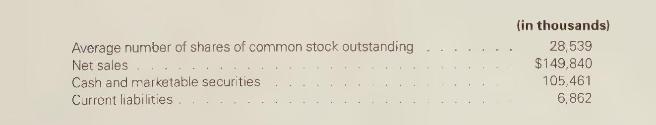

i. Given the following data, calculate the cash flow per share of common stock ratio, the cash flow margin ratio, and the cash flow liquidity ratio. (Round the net cash provided from operating activities to the nearest thousand before you calculate the ratios.) How do the ratios compare with the ones for companies illustrated in the chapter?

16.4 Founded in 1901, The Gillette Company is the world leader in male grooming products, a category that includes blades and razors, shaving preparations and electric shavers. Gillette also holds the number one position worldwide in selected female grooming products, such as wet shaving products and hair epilation devices. The Company is the world's top seller of writing instruments and correction products, toothbrushes and oral care appliances. In addition, the Company is the world leader in alkaline batteries.

Gillette manufacturing operations are conducted at 64 facilities in 27 countries, and products are distributed through wholesalers, retailers, and agents in over 200 countries and territories.

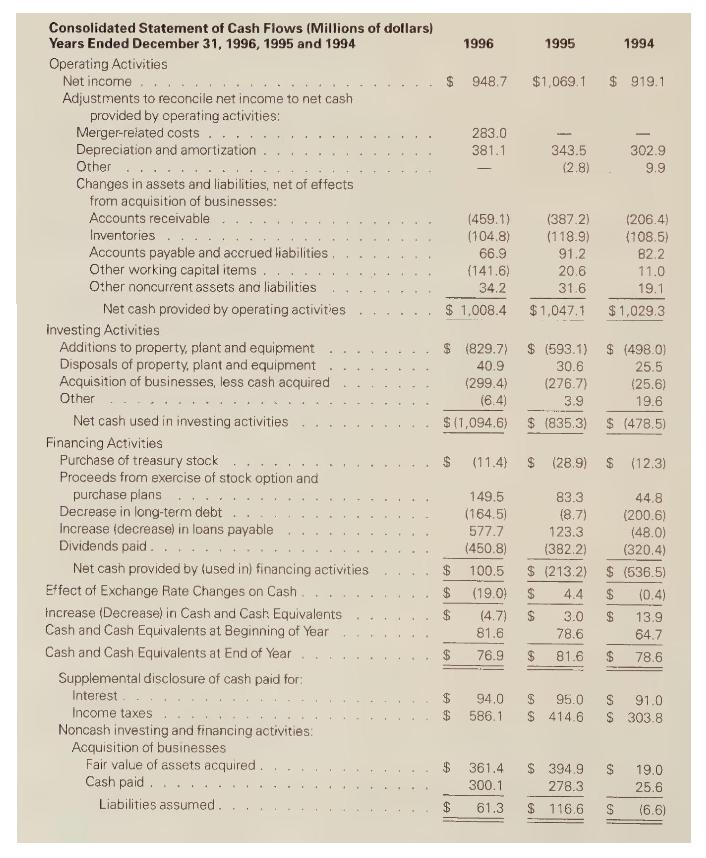

The company's statements of cash flows for the years 1994-1996 follow. Then the relevant portion of Management's Discussion and Analysis of the statement of cash flows is provided.

\section*{Management's Discussion and Analysis* Financial Condition}

Since the Gillette merger with Duracell was accomplished through the exchange of stock, with no new debt incurred, the Company's financial condition continued to be strong in 1996. Net debt of the Company increased \(\$ 422\) million during 1996 , reflecting spending for the acquisition of businesses in the Company's core categories, particularly the battery business, and increased capital spending.

Net debt (total debt net of associated swaps, less cash and short-term investments) at December 31, 1996, amounted to \(\$ 2.08\) billion, compared with \(\$ 1.66\) billion in 1995 and \(\$ 1.43\) billion in 1994 After the issuance of shares for the exchange with Duracell shareholders, the Company's market value exceeded \(\$ 43\) billion at the end of 1996 , while book equity amounted to \(\$ 4.49\) billion. Stock repurchase programs of Gillette and Duracell were terminated after the merger was announced in 1996.

Net cash provided by operating activities in 1996 was \(\$ 1.01\) billion, compared with \(\$ 1.05\) billion in 1995 and \(\$ 1.03\) billion in 1994. Growth in working capital requirements in all three years reflected the growth in the business. The current ratio of the Company was 1.62 for 1996, compared with ratios of 1.58 for 1995 and 1.66 for 1994 .

Capital spending in 1996 amounted to a record \(\$ 830\) million, compared with \(\$ 593\) million in 1995 and \(\$ 498\) million in 1994. Spending in all three years principally reflected significant investments in the blade and razor, Duracell and Braun product segments.

In 1996 , the Company spent \(\$ 300\) million for acquisitions, principally in the battery business, compared with \$278 million in 1995 and \$26 million in 1994. Acquisitions in 1995 and 1994 were in other core business areas In December 1996, the Company replaced the revolving credit facilities of Gillette and Duracel with new revolving facilities provided by a syndicate of 19 banks for \(\$ 400\) million, expiring December 1997, and \(\$ 1.1\) billion, expiring December 2001. The Company will continue to use these facilities to provide back-up to its commercial paper program.

The Company generally borrows through the U.S. commercial paper market. At year-end 1996, there was \(\$ 1.09\) billion outstanding under the Gillette and Duracell commercial paper programs, compared with \(\$ 599\) million at the end of 1995 and \(\$ 510\) million at the end of 1994 .

Both Moody's and Standard \& Poor's reconfirmed the Company's long-term credit ratings in 1996 following the merger announcement. Moody's rates the Company's long-term debt Aa3, while the Standard \& Poor's rating is AA-. The commercial paper rating is P1 by Moody's and A1+ by S\&P.

Gillette will continue to have capital available for growth through both internally generated funds and substantial credit resources. The Company has substantial unused lines of credit and access to worldwide financial market sources for funds.

*Source: The Gillette Company's 1996 annual report, p. 22 .

a. Does the company use the direct or indirect methods of calculating net cash provided by operating activities?

b. Did the merger-related costs result in a cash outflow in 1996? Explain.

c. Determine whether each of the current assets (other than cash) and current liabilities increased or decreased during 1996 .

d. How is the company expanding its asset base?

e. How much greater is the total market value of the company's outstanding shares of common stock than the book equity (stockholders' equity)?

f. What is the likelihood that the company will be able to pay at least the current level of dividends in the future?

g. Do you expect to see purchases of treasury stock increase or decrease in the future?

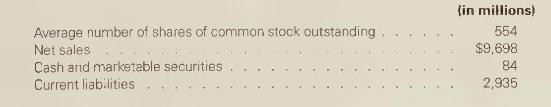

h. Given the following data, calculate the cash flow per share of common stock ratio, the cash flow margin ratio, and the cash flow liquidity ratio. (Round the net cash provided by operating activities to the nearest million before you calculate the ratios.) How do the ratios compare with the ones for companies illustrated in the chapter?

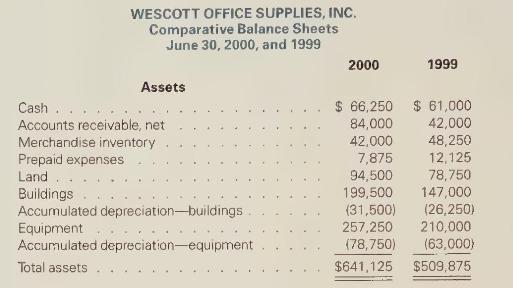

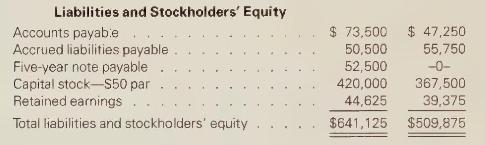

16.5 The following information is from the accounting records of Wescott Office Supplies, Inc., for the fiscal years 2000 and 1999 :

Additional data 1. Net income for year ended June 30,2000 , was \(\$ 56,250\).

2. Additional land was acquired for cash, \(\$ 15,750\).

3. No equipment or building retirements occurred during the year.

4. Equipment was purchased for cash, \(\$ 47,250\).

5. The five-year note for \(\$ 52,500\) was issued to pay for a building erected on land leased by the company.

6. Stock was issued at par for cash, \(\$ 52,500\).

7. Dividends declared and paid were \(\$ 51,000\).

8. The company paid interest of \(\$ 10,000\) and income taxes of \(\$ 40,000\).

Required

a. Prepare a working paper for a statement of cash flows.

b. Prepare a statement of cash flows under the indirect method. Also prepare any necessary supplemental schedule(s).

Step by Step Answer:

Financial Accounting A Business Perspective

ISBN: 9780072289985

7th Edition

Authors: Roger H. Hermanson, James Don Edwards